Leverage in Options and the seemingly unlimited credit

In 2022, Warner Brothers released the movie Elvis, which explores the complex and sometimes contentious relationship between the King of Rock and Roll, Elvis Presley, and his longtime manager, Colonel Tom Parker, played by Hollywood icon Tom Hanks.

As portrayed in the movie, Parker, a compulsive gambler, raked up huge gambling debts and the casino executives called in these debts to pressure Parker to get Presley into an exclusive residency deal. Parker did get Presley a lucrative contract, but the performance schedule was so demanding that it left Presley mentally and physically exhausted. To keep Presley on stage, Parker enlisted the services of an ethically questionable doctor who prescribed Presley prescription drugs, to which Presley eventually became addicted.

Unbeknownst to Presley, Parker negotiated a side agreement with the casino where his gambling debts were forgiven, and Parker got unlimited credit as long as Presley continued performing at the casino.

Options are a type of derivative. They provide the right, but not the obligation, to execute the contract. Derivatives can greatly increase leverage. Leverage by itself can be a great tool that speeds up wealth generation. On the other hand, in the hands of humans, and as Warren Buffett described, derivatives can be “financial weapons of mass destruction.”

Firms and individual investors can lose a lot of money very quickly. You can also lose everything you invest in a single day.

There are a few great articles from Alvin Chow and Jason Cai (see below).

How I Blew Up A Full Year’s Salary In My Trading Account (read here)

My Nvidia Time Bomb (-USD141.5k Unrealised Loss & Counting) | Why You Should Never Sell Naked CALL | The Danger Of Short Selling (read here)

Getting Liquidation Warning | Why I am Getting Liquidation Warning & What You Can Do If You Get Liquidation Warning (read here)

For anyone with a gaming compulsion, unlimited credit is heaven-sent…and Options as a financial leverage product are very close to that, if not for margin calls.

To quote Alvin (emphasis mine): The price went up and the margin got bigger. On 27 Jan 14, I received a margin call from the broker. He asked if I would top up cash to the account to meet the margin requirement. The price of NG was $5.37 and no where near the strikes. But because my position was too big, I did not have enough margin to buffer the rise in price. I refused and wanted to ask for time to close the position when the US market opened at night (Singapore time), as the liquidity was low during Asian market trading hours and the options pricings were erratic with wide spreads. He said he was powerless to grant the request and the margin team will have to close the positions. And sure they did. They closed all my contracts which wiped out my entire capital. That was US$82k!

The Black Swan in Options Trading

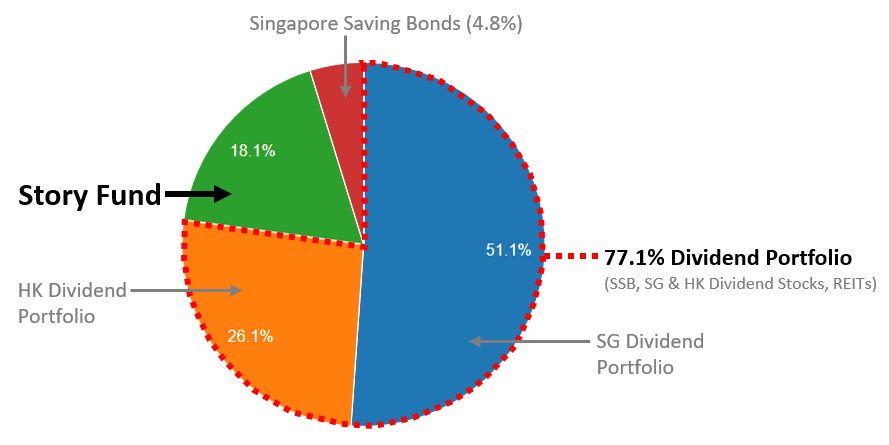

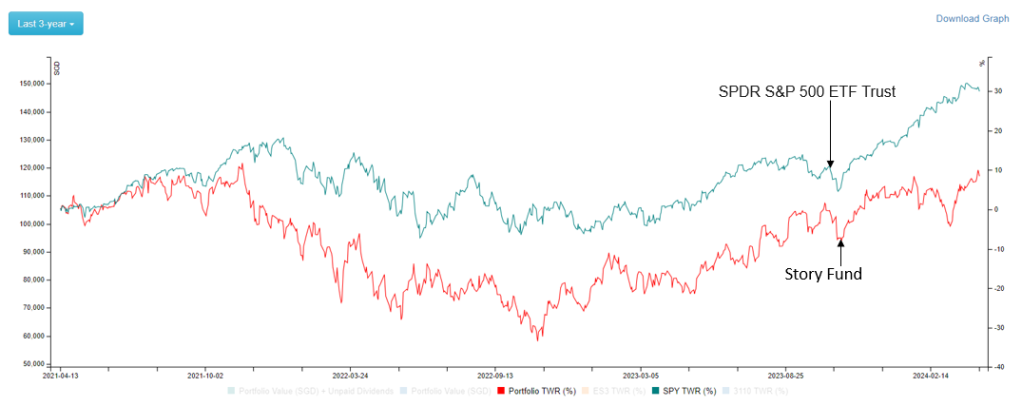

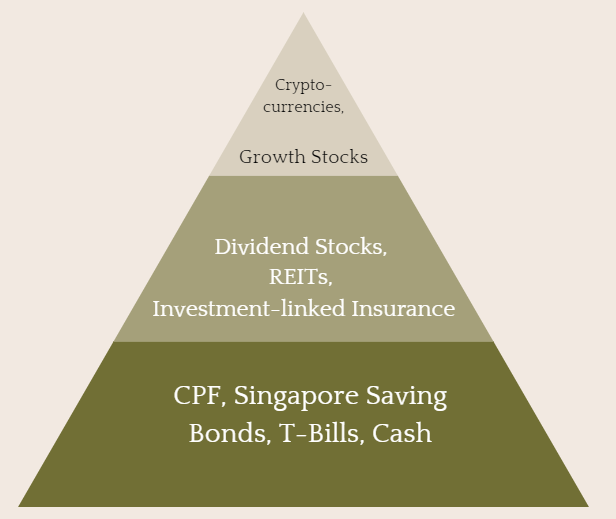

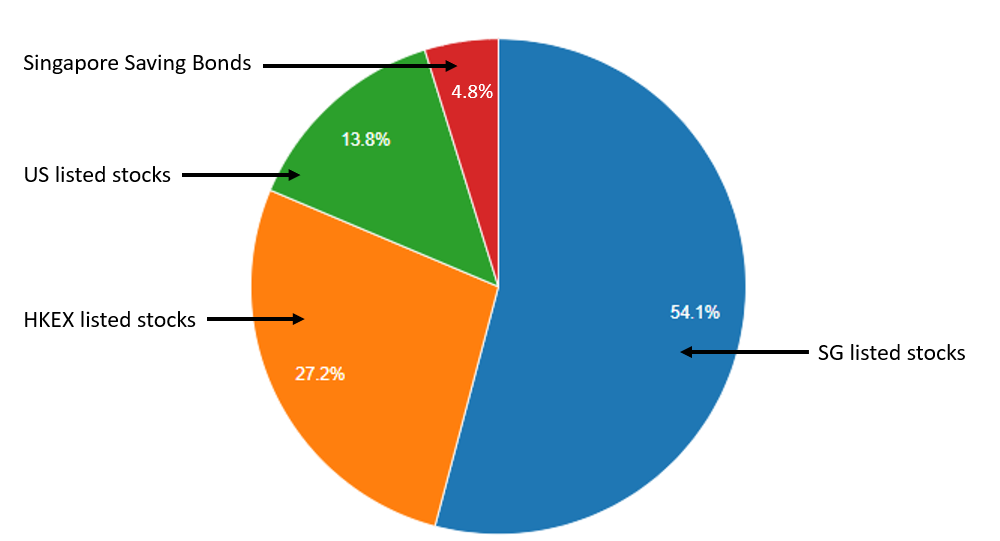

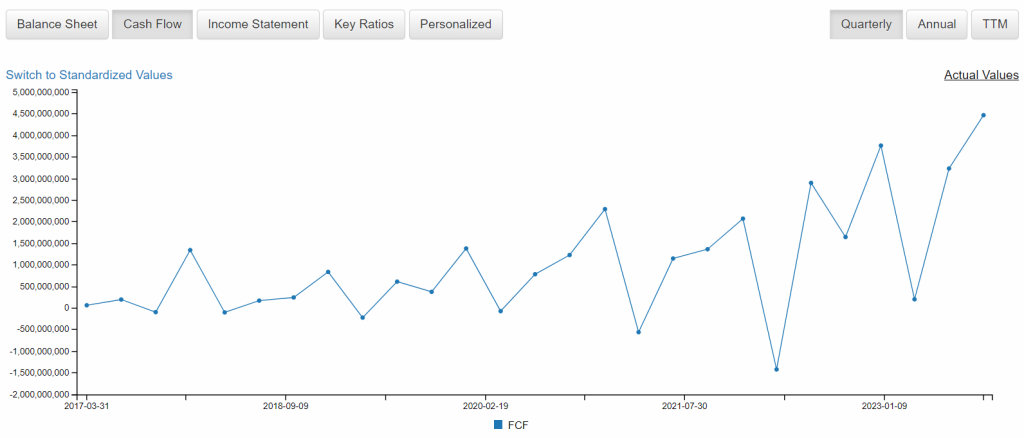

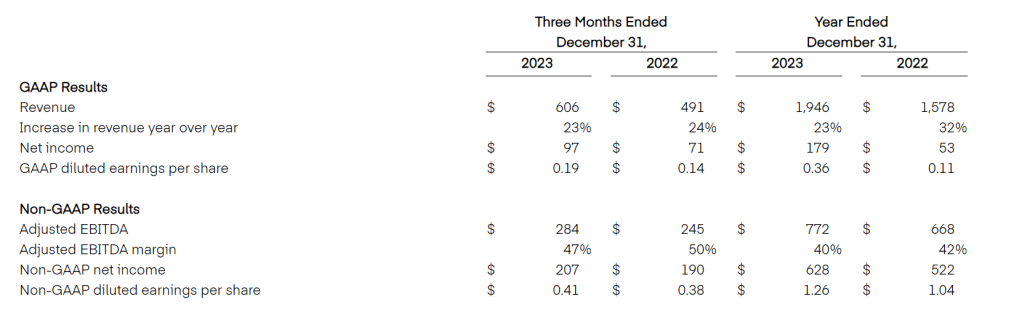

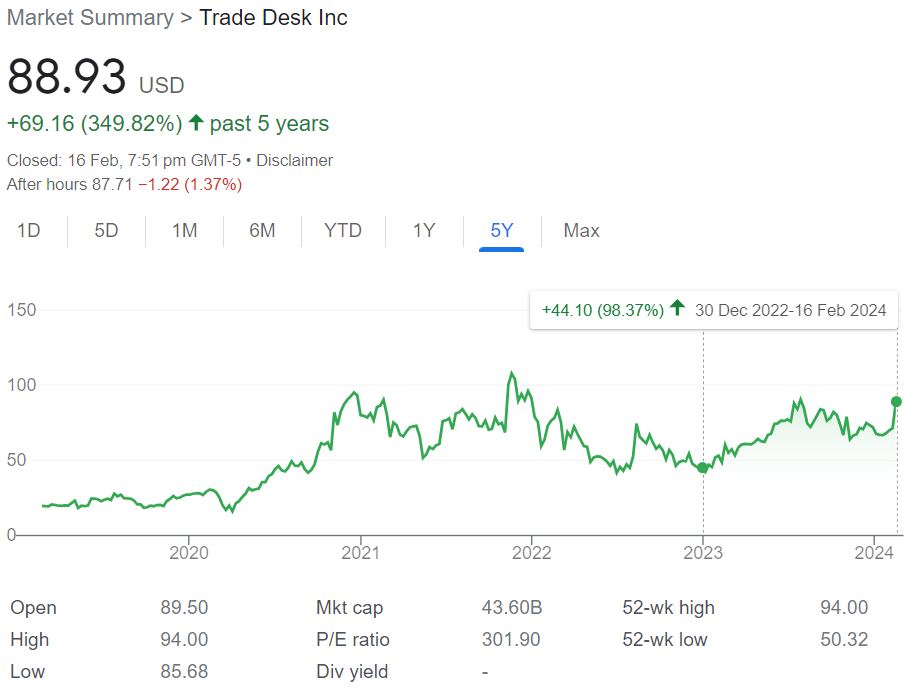

Personally, I have always traded using my growth stocks such as Tencent, Alphabet, Pinduoduo, MasterCard, The Trade Desk, etc. I typically trade with what I have, but I do occasionally do some naked options trades with odd lots.

I think Alvin said it best:

“I was my own Black Swan

I didn’t blow up because of an external Black Swan event. I feared the Black Swan but I didn’t know what it is. No one does. Only on hindsight we know what the Black Swan is. I was my own Black Swan – the real me deviated from the perception of myself.

I perceived myself as a very disciplined trader and person in life. I adhere to rules and routine very well. But when I really think back, I do take shortcuts sometimes and I bend the rules a little, believing everything will be fine. Bending most rules were inconsequential. Bending rules when stakes are high is a killer.”

“So what is the difference between selling options or any other strategies? I see one similarity rather than differences – all are risky. I agree with Jon I am picking pennies in front of the steamroller. But this is similar to scalpers, swing traders and trend followers. I will try to jump away from the steamroller as fast as I can so that I can continue to pick the pennies. Jon questioned my overconfidence in jumping off in time and I admit I stand a chance to blow up, without a doubt. And if I do, I hope he will pick me up from there.”

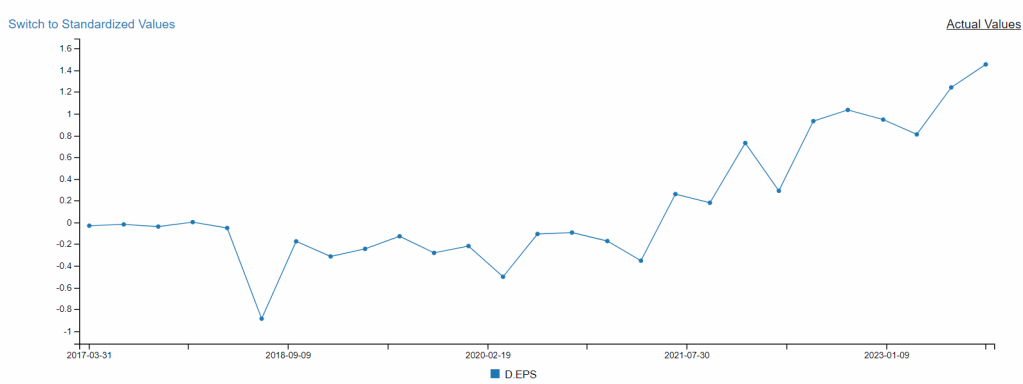

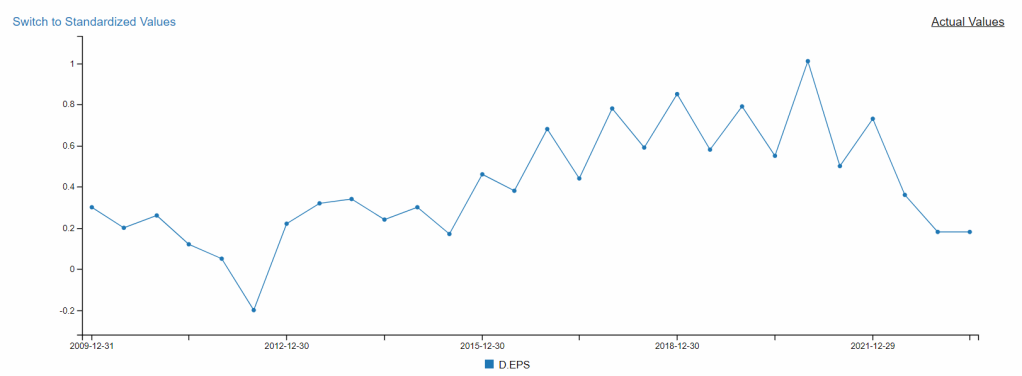

Why Dividend Stocks are terrible for Selling Options

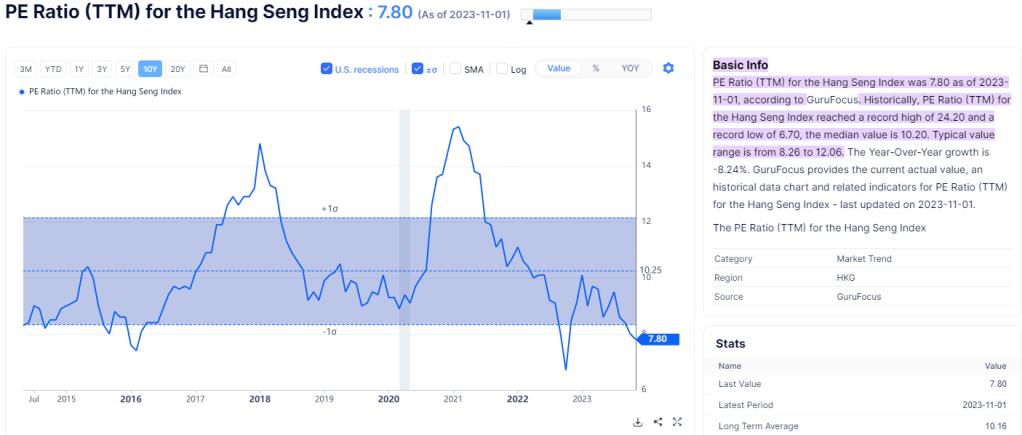

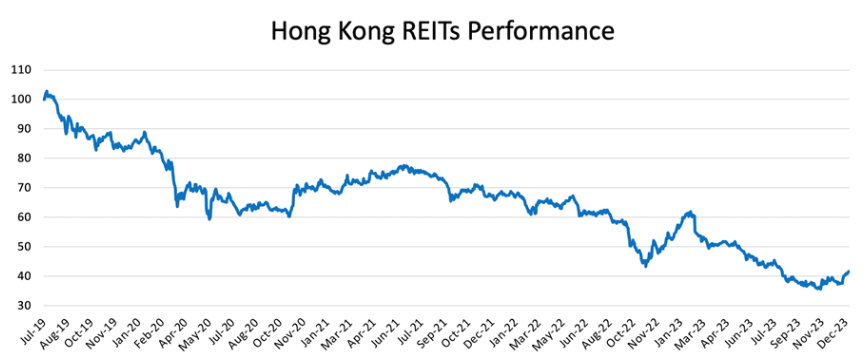

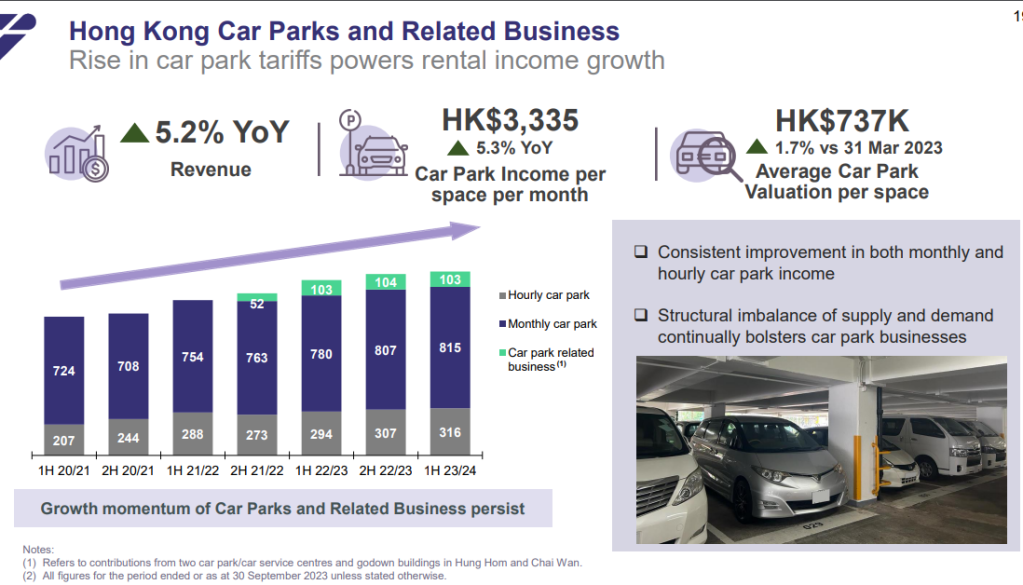

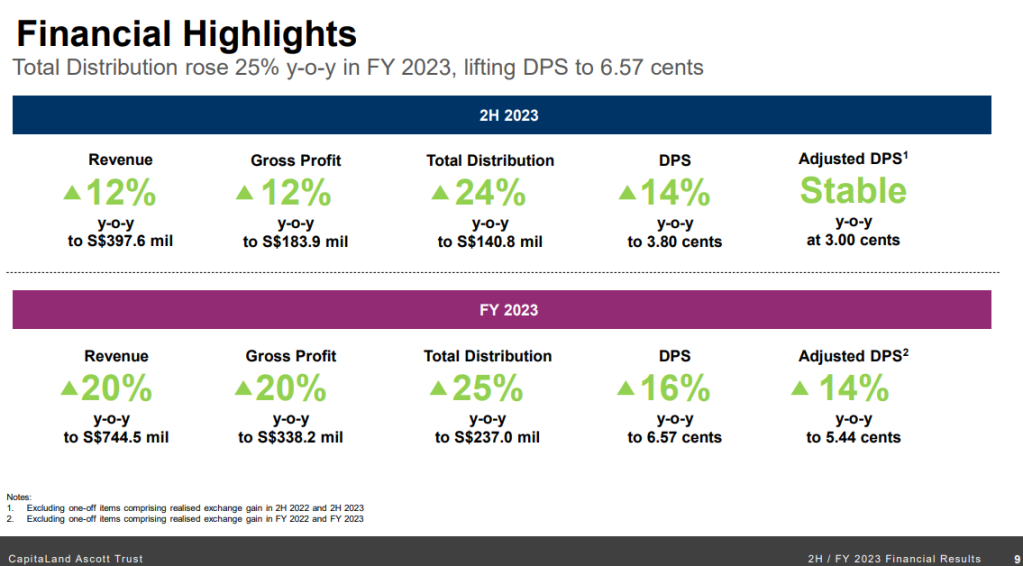

I seldom used my HK-listed dividend stock. For the few times when I tried, I often ended up losing money doing so.

Firstly, the premiums from these low liquidity options positions are really low even if the duration is long. With low premiums, I may be tempted to buy more lots (more than I have assets to cover).

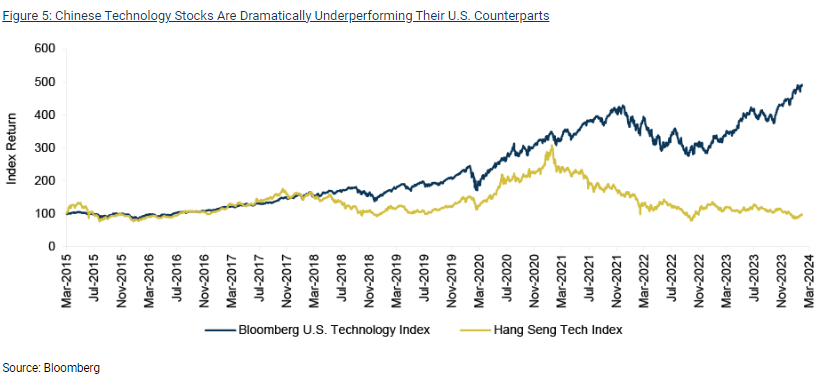

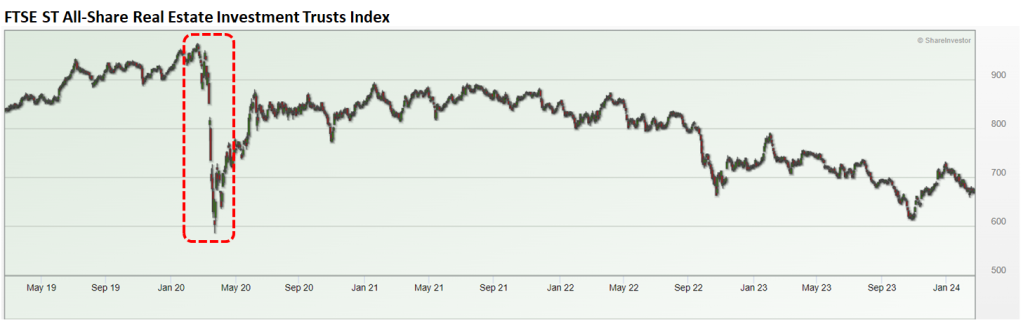

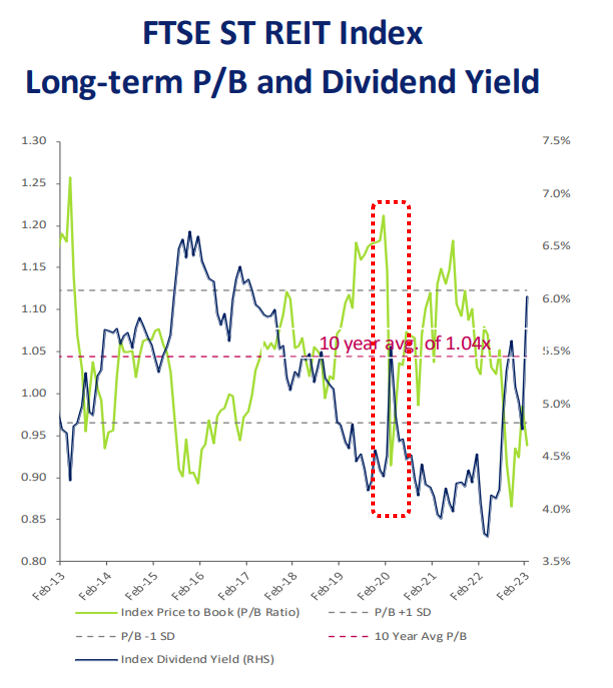

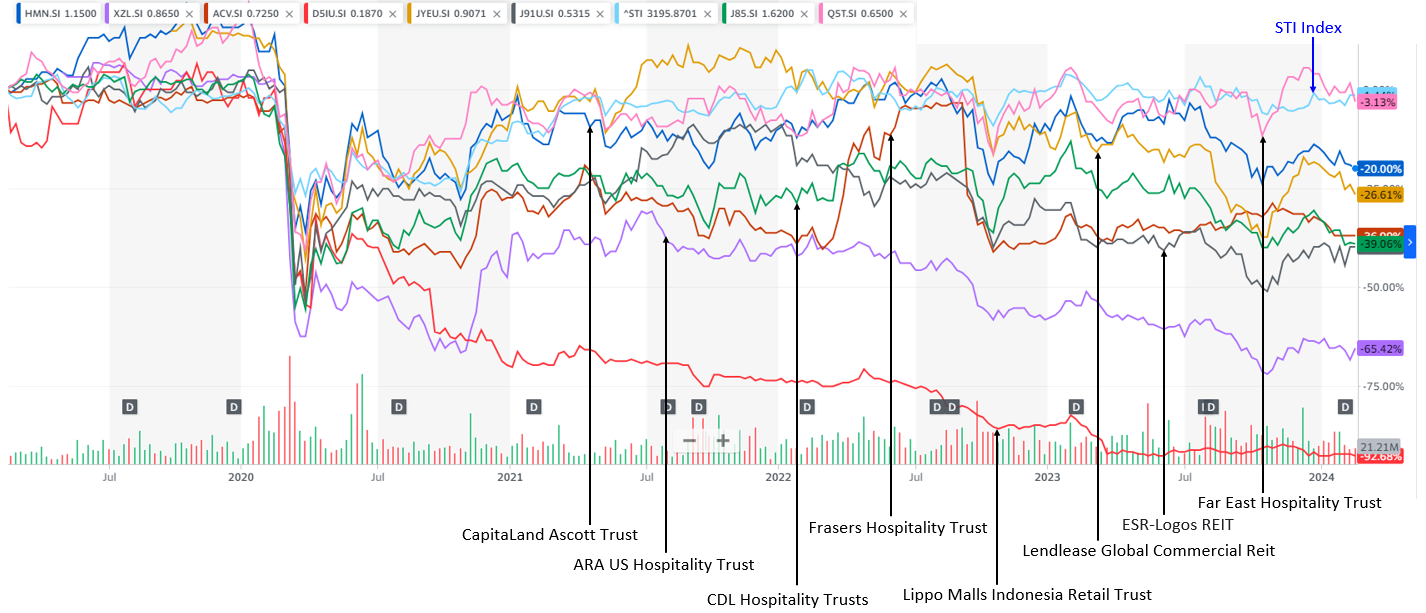

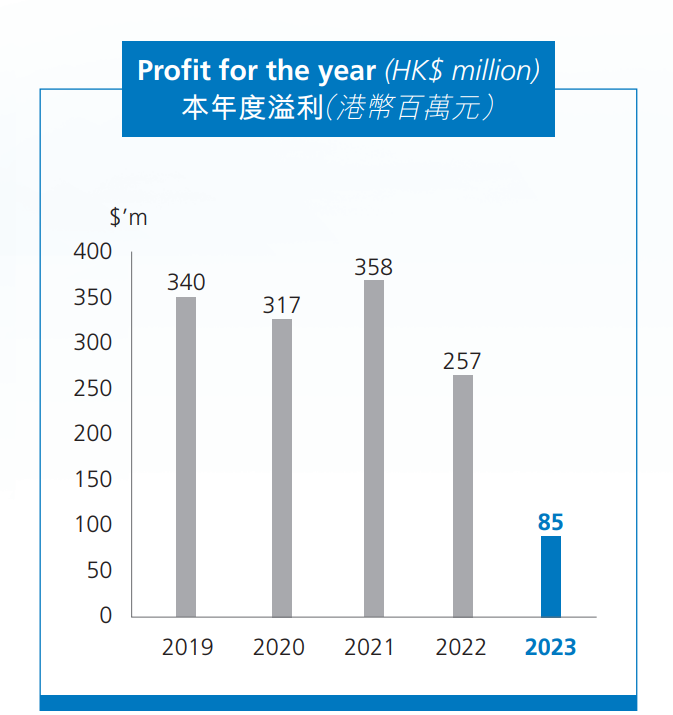

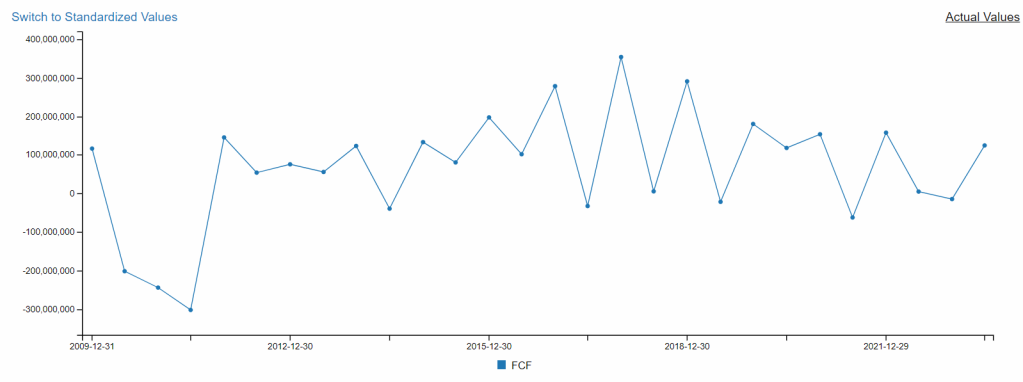

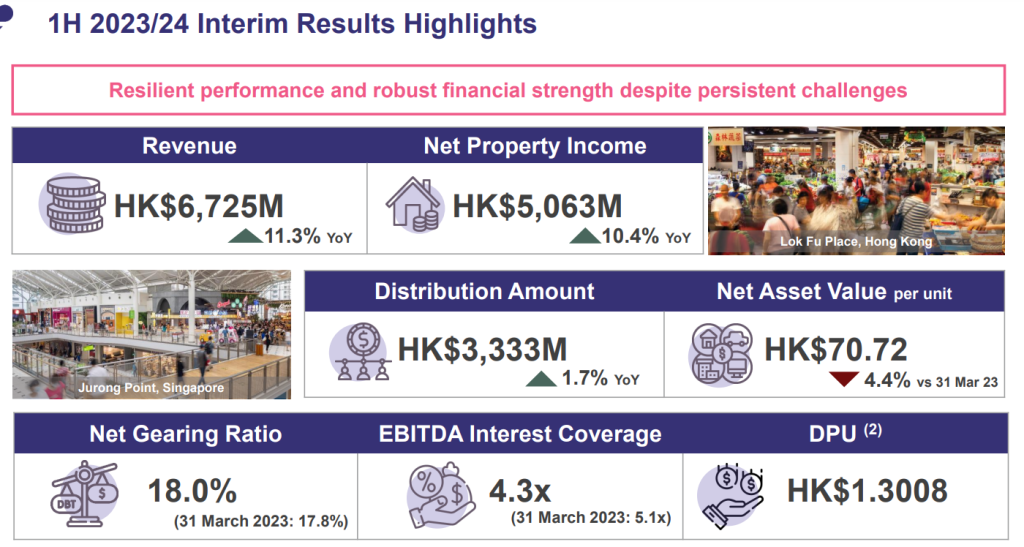

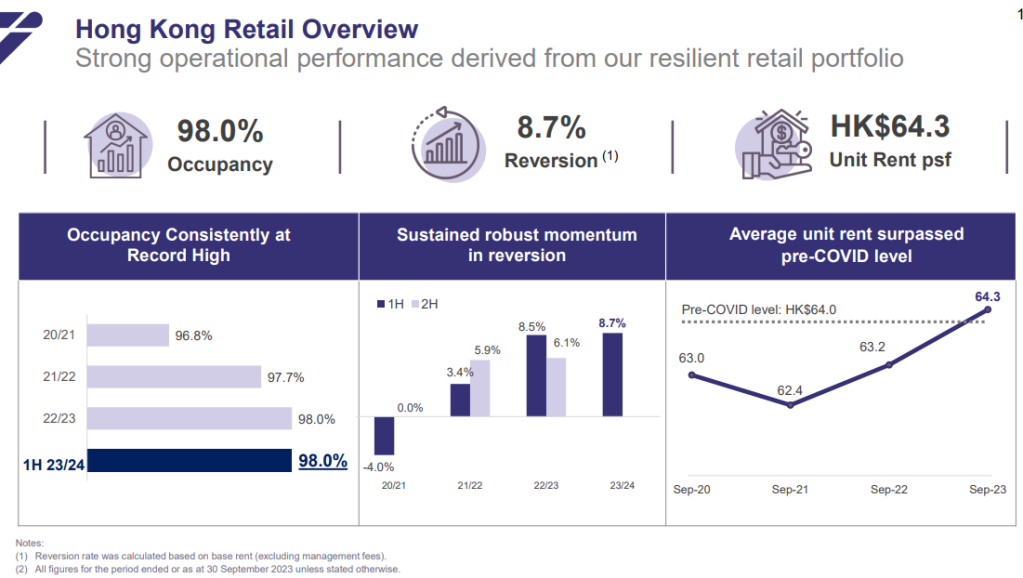

In addition, by having an excessively long duration, I further expose myself to price fluctuations although huge price fluctuations are rather rare for these dividend stocks. However, rare does not mean it does not ever occur. In fact, it did occur a couple of years back when the Chinese authorities made drastic policy changes that generated fear (or exuberance) in the general market, and even mega-cap stocks like Sun Hung Kai Properties, CK Assets ‘ stock prices corrected furiously in a few days. In addition, for every 0.1 percentage change in stock prices, there are magnified percentages (100+% or 1000+%) change in option premium prices.

Such is the power of leverage.

The other feature about HK-listed stocks as compared to US-listed stocks which I noticed, is that for the former, 1 lot does not necessarily mean an underlying 100 shares. It could mean 150, 500 or 1000 shares per lot.

That Restless Night

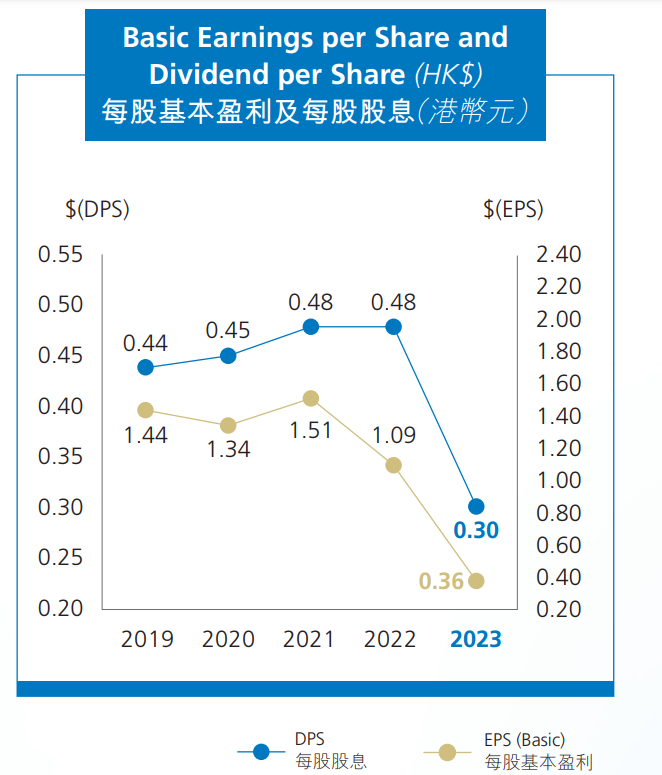

This restless night relates to one of the rare times when I attempted to sell call options on an HK-listed property stock (Sun Hung Kai Properties).

One thing that I have learned really really fast is not to trade options when I am tired or busy. My mind is just unable to focus and numbers become blurry. A simple bad trade can be costly. It is made even worse when I am selling options on a stock that I am unfamiliar with.

For the record, I do own some shares of Sun Hung Kai Properties (not a lot of shares, but at HKD 73 or SGD 12.68 per share, with brokers typically requiring me to buy/sell in lots of 500 shares, I wouldn’t consider it a penny stock).

I do have a few trading accounts with various brokers. My Sun Hung Kai Properties (SHKP) shares are in my Tiger Brokerage account, which in total have around a low 6-figure SGD value (considering all the other stocks in that account).

So there was one day when I was rather busy at work. Late that afternoon, I decided to try selling call options using my Sun Hung Kai stocks. I looked at my StocksCafe account, which listed the position value and the number of shares for each stock I owned. I made the stupid blunder of confusing the position value with no. of shares. I have a 4-figure no. of shares for Sun Hung Kai which has a 6-figure value (HKD). So I thought I had a 6-figure no. of shares.

For SHKP options, 1 lot = 1000 shares (not 100 shares). So since I thought I have 6 figures (xxx xxx) no. of shares (when I actually only have xxxx no. of shares), I will just sell xxx nos. of lots. This netted me a 4 figure SGD premium (not bad I thought), given the extremely low probability of the stock price hitting the strike price (literally looking at the Delta and IV, it is actually less than a 2% chance).

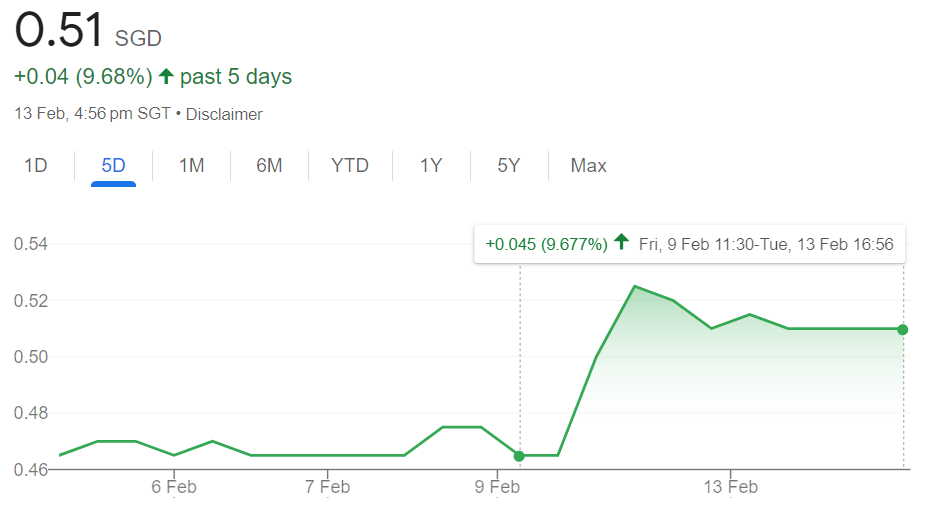

Shortly after my positions were filled, the market closed. Subsequently, I noticed that my account liquidity is extremely low and is actually at Risk.

So I started reviewing the numbers. When I realized that the underlying shares under the options I sold were close to 100 times the number of shares I actually have, and since 1 lot is equal to 1000 shares, the underlying value of the shares for the option position is more than HKD 12,000++k or SGD 2++ mil. I almost freaked out (I don’t have SGD 2 mil worth of SHKP shares, I only have a low 6 figures HKD worth or low 5 figures SGD worth of SHKP shares).

Although there was a very low chance of the stock price ever rising to the strike price, it could still happen. In addition, even before it hits, my entire Tiger Brokerage account would probably be wiped out (liquidated) due to margin calls.

I tried to close the options position during the after-market hours (e.g. buy the options), and I got a ridiculous premium price which was more than 100 times the options premium price I sold, which was different from the price shown for that strike price. I reckon it is 1) Aftermarket, there were no sellers 2) Glitch in the system.

So in gist, I had a naked call option position of more than SGD 2++ mil. I sold call options and received a 4-figure premium, to buy back those same options during the aftermarket hours, I would need to pay a 6-figure premium.

The Hong Kong stock market trading session covers periods from 9:30 am to 12:00 noon and 1:00 pm to 4:00 pm each trading day. It ends earlier than the Singapore stock market. In other words, I had a longer period of being tormented by my mind. Dinner was tasteless and I could not focus on the TV show or conversations with my family.

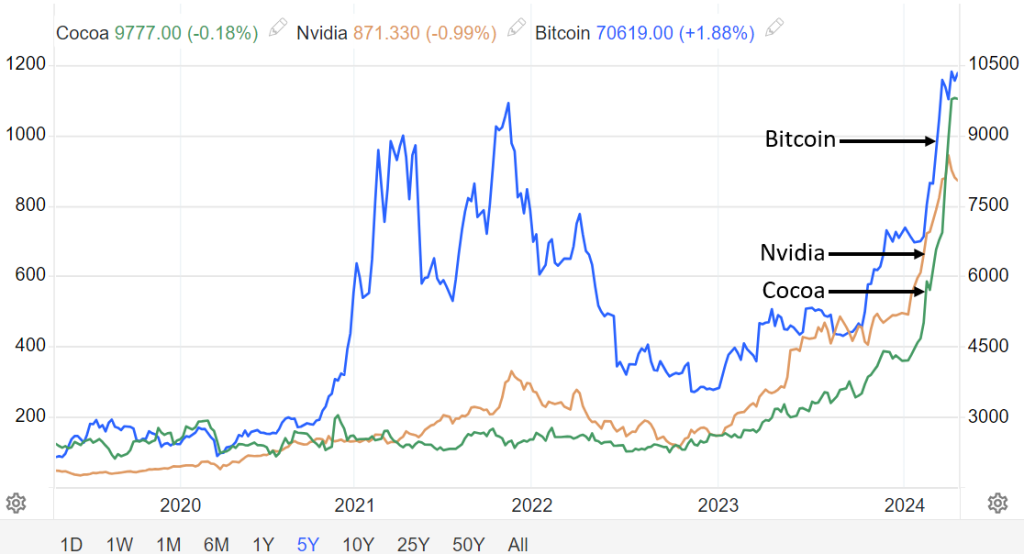

I literally had the MOST unrestful night ever that night. With my account value (6 figures SGD), I can actually use leverage via options to have access to more than 10 times the value of stocks. With every small percentage change in stock price, the percentage change in option premium prices is magnified! I can’t imagine what it would be like if it were options for volatile stocks like Nvidia.

For what… for a few ‘pennies’ (of Options premiums)?

The next morning, I managed to close my option position at a slight loss. Which I am thankful for. At least from then on, I can sleep in peace.

Yes, options are as close as we can get to unlimited credit, but it is something I wish I never had. In retrospect, I am surprised that I could actually access that much value of shares with the low-cost brokerage account value I had. Still, it is something I wish I never had.

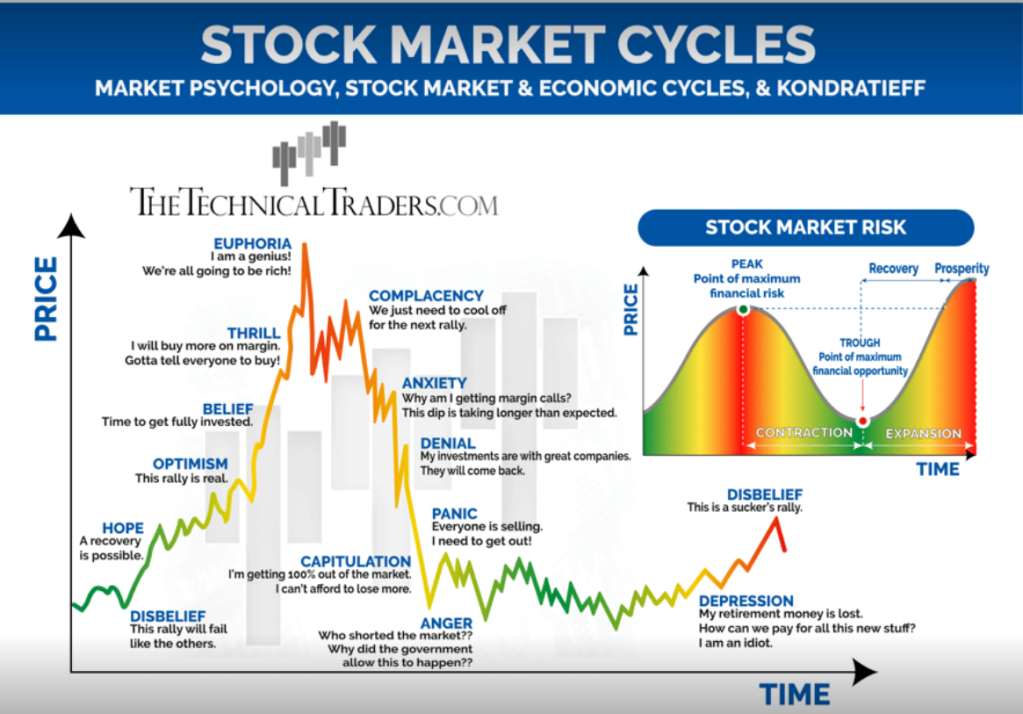

We often heard success stories from people who used leverage, to get rich quick. Well, I just hope I am not my own black swan and has a good night rest.

Thank you for reading.

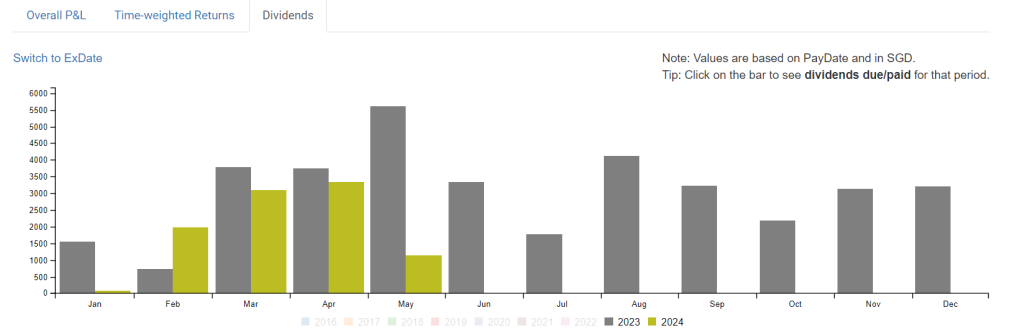

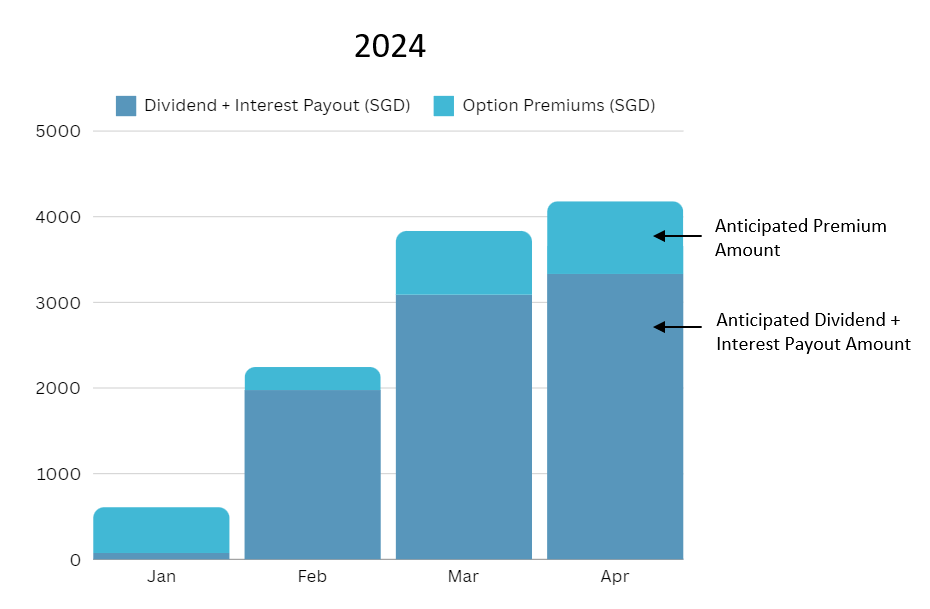

StocksCafe

FYI I find StocksCafe useful for the tracking of my own portfolio, and I especially like to use it to track my portfolio stock dividend/bond interest payouts (projected and due). You can use my referral code: apenquotes. Just click here. Upon signing up using the referral code, you will get to enjoy being a Trial Global Friend of StocksCafe and test out all features for free for one month!

Please follow me at StocksCafe, via my StocksCafe profile page.

BigFundr

BigFundr offers real estate-backed investment deals. Your principal and interest are 100% guaranteed by Maxi-Cash when you invest with BigFundr. Sign up now using my referral code R26458M. You will get S$10 as a reward!

Dobin

I have started using this personal finance app: Dobin. It helps to manage my money and save on everyday purchases. Download the app here: https://www.dobin.io/download

PS: Make sure to enter my referral code when you signup: LNPKMFS

Webull

Sign up for a Webull account via my referral link and get up to $2,500 worth of Tesla shares.

Tiger Brokers

For the Singapore market, Tiger Brokers currently waive the minimum fee and only charge a 0.08% trading fee. This drastically reduces your cost as the minimum fee from other brokers (ranging from SGD 8 such as FSMOne and SCB, to SGD 25 for local brokerages) does add up and can eat into your returns.

Tiger Broker Referral Code:: GPE59H

I would like to invite you to start investing with Tiger Brokers so you can claim your welcome bundle.

Sign up here.

FSMOne.com

Typically I use FSMOne.com to invest in funds & ETFs (including money market funds).

If you do not have an account, you can sign up here. Please use my FSMOne referral code: P0031127, when you sign up.

Wise Card

Traveling overseas? The Wise card lets you spend money around the world with low conversion fees and zero transaction fees. Please use my referral link to sign up for one.

Shopee

I have been using Shopee for a while and think you will like it as much as I do.

Get $10.00 off your first purchase using my code DARREB52.

Download Shopee now and enjoy hot deals at the best prices! Click here.

Happy shopping!

Gemini

As stated by MoneySmart on Jan 22, if you’re looking to optimise trading your crypto with relatively low fees, simple-to-grasp expert UI and ease of purchase with Singapore dollars. then the best crypto exchange in Singapore is Gemini,

If you do not have an account, you can sign up here using my referral link. After you have signed up, once you buy or sell US$100 or more (or 100 USD equivalent of your domestic currency) within 30 days of creating your account, your account will be credited US$10 (or 10 USD equivalent of your domestic currency) worth of bitcoin.