My Portfolio

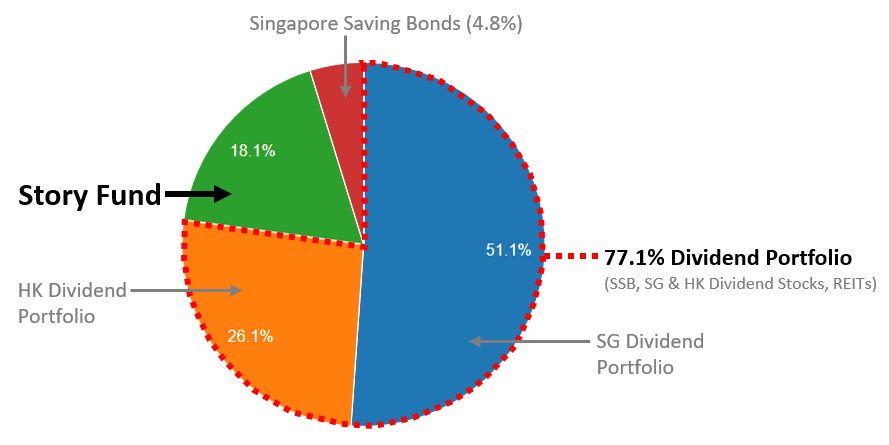

I have a mixture of growth stocks, dividend stocks, REITs, and SSBs in my portfolio (not counting my CPF, T-Bills, cash, insurance, property, etc).

As mentioned here, my portfolio basically consists of a Dividend Portfolio and a Story Fund. The Dividend portfolio consists of 2 parts: the Singapore Portfolio and the Hong Kong Portfolio. The Story Fund consists of US and Hong Kong-listed growth stocks. The stocks within each portfolio might have changed much.

To be frank, in recent years, I have been actively investing and adding to my dividend portfolio, and building up my war chest via the Singapore Saving bonds (and cash). Currently, the dividend portfolio occupies approximately 77.1% of my portfolio value. While the Story Fund portfolio on the other hand only occupies 18.1% of the total value. So yeah, in a way, the Story Fund was kind of neglected.

The Story Fund

Initially, I wanted to create this barbell portfolio consisting of both growth stocks, to capture the future growth and dividend portfolio for cash flow. I got the inspiration for the name ‘Story Fund’ from the financial YouTuber Joseph Carlson.

My Story Fund Stock Portfolio (read here)

It is a relatively small portfolio consisting of both US-listed and HK-listed growth stocks ie. Alphabet, Mastercard, The Trade Desk, Tencent, Pinduoduo, Baidu and Meituan. I got the Meituan stocks as a payout from Tencent.

The performance of these stocks has been rather erratic.

The US-listed stocks clearly are the outperformers here, where I more than 2x my original vested amount with Alphabet stocks. I also have unrealized gains from Mastercard and The Trade Desk.

I divested my Alibaba stocks in around mid-2022 at a loss and used the liquidated amount to invest in Tencent. Currently, my investment in Tencent is at a slight loss (less than 10%).

Among the ‘Chinese growth stocks’, the outlier is Pinduoduo (PDD), which is in positive territory (unrealized gains) due to its impressive earnings. FYI, PDD is listed in the US Market, not in Hang Seng.

The negativity associated with geo-political risks, lackluster property and economic growth in China, and restrictions imposed by the US on China on AI chips seem to have little effect on PDD. Investors appear to focus more on the optimism of the profit growth generated by Temu. In fact, I was rather surprised by its strong stock price performance, it appears to be at odds with the general gloomy outlook. Nevertheless, PDD P/E is only at 20.31 despite its 93% rise in annual profit. I can only imagine what its stock price chart would be like without the macro pessimism.

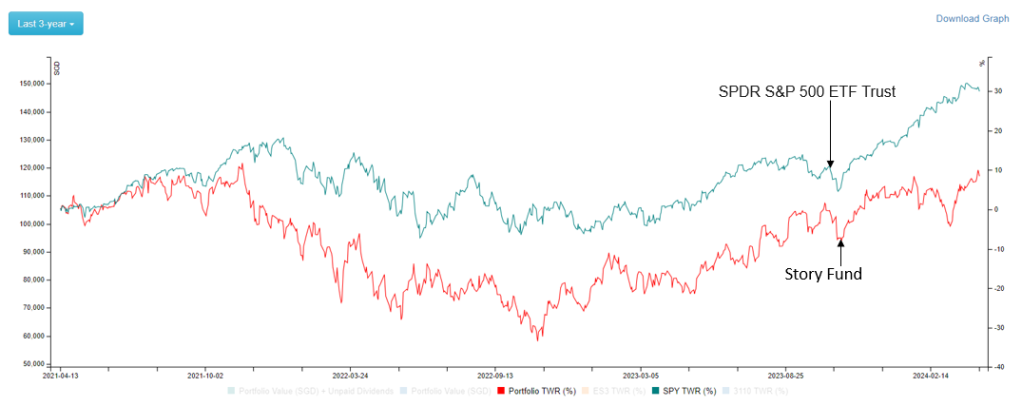

As per the below chart, the Time Weight Returns (TWR) of my Story Fund portfolio have underperformed the S&P 500’s TWR. I reckon it is due to the HK-listed growth stocks in that portfolio. They are like weights tied to the ankles.

These days, my focus has been more on income cash flow (i.e from dividends primarily and also from premiums via selling options of growth stocks). I guess, as I slowly inch towards the retirement age, my mindset is more on how to replace my active income when I eventually stop working.

Article from Oaktree

I came across this article by Oaktree dated 28 March 2024, which I find rather insightful. Please see below.

The Roundup: Top Takeaways from Oaktree’s Quarterly Letters – March 2024 Edition (read here)

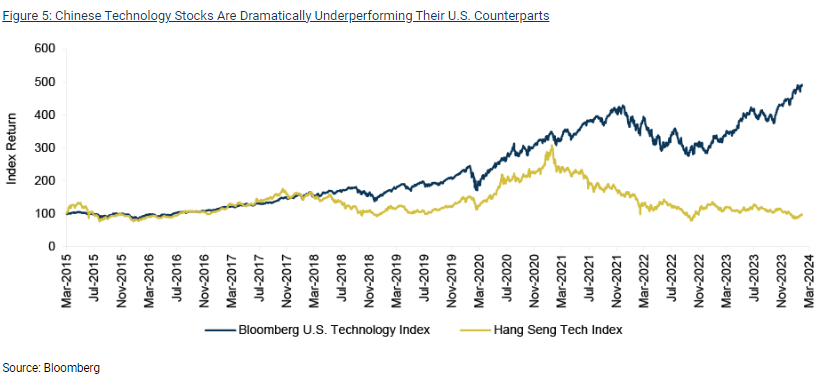

I find section 6 of the article titled “Emerging Markets Equities: Piling On” rather interesting (highlighted portion by me).

I extrapolated the iShare U.S Technology ETF chart and the Hang Seng Tech Index ETF. Currently, the iShare U.S Technology ETF has a P/E (TTM) of 40.59 while the ishare Hang Seng Tech Index ETF has a P/E (TTM) of only 17.14.

As I was looking at the chart and reading the article, my personal feeling is that Chinese growth stocks are just punished despite their improving fundamentals. Perhaps in addition, to the risks mentioned earlier, there is also a certain opaqueness when it comes to Chinese Stocks. As investors, we are always concerned about accountability (esp. when things go south).

The rise of Pinduoduo and Temu: profits and secrets | FT Film (Watch here)

There was a time when Chinese stocks were all the buzz and their prices tracked the rise and fall of their US counterparts (before 2021). These days, the buzz has died down, replaced by the silence of untold losses.

What is measured gets done

As per my earlier post, I have been doing some option selling, and I do see the benefit of doing that while waiting for the Chinese growth stocks to eventually play catch up with their US counterparts. It could be years…

Tracking my Passive Income (read here)

While the annual cash flows of Alphabet, Mastercard, and The Trade Desk (the latter two in particular) have improved in recent years, PDD, Tencent, Baidu, and Meituan’s annual cash flows have also improved. Stock prices did not keep up.

I decided to do a quick stocktake of my past investment moves in my Story Fund portfolio against the above-mentioned charts.

Looking at it, I realized that I made a few purchases of US growth stocks in late 2022, and did not make any US growth stock purchases in 2023, while the US Tech sector prices marched up. After 2021, I have been adding more to my HK growth stocks although I divested from Alibaba and replaced it with Tencent in around mid-2022.

I only made a couple of purchases of HK growth stocks in 2023.

Recently, I sold a put option on Tencent stocks, and the price went below the strike price. I reckon the option should be exercised soon and I will be allocated the Tencent shares.

A small step onwards.

Thank you for reading.

StocksCafe

FYI I find StocksCafe useful for the tracking of my own portfolio, and I especially like to use it to track my portfolio stock dividend/bond interest payouts (projected and due). You can use my referral code: apenquotes. Just click here. Upon signing up using the referral code, you will get to enjoy being a Trial Global Friend of StocksCafe and test out all features for free for one month!

Please follow me at StocksCafe, via my StocksCafe profile page.

BigFundr

BigFundr offers real estate-backed investment deals. Your principal and interest are 100% guaranteed by Maxi-Cash when you invest with BigFundr. Sign up now using my referral code R26458M. You will get S$10 as a reward!

Dobin

I have started using this personal finance app: Dobin. It helps to manage my money and save on everyday purchases. Download the app here: https://www.dobin.io/download

PS: Make sure to enter my referral code when you signup: LNPKMFS

Webull

Sign up for a Webull account via my referral link and get up to $2,500 worth of Tesla shares.

Tiger Brokers

For the Singapore market, Tiger Brokers currently waive the minimum fee and only charge a 0.08% trading fee. This drastically reduces your cost as the minimum fee from other brokers (ranging from SGD 8 such as FSMOne and SCB, to SGD 25 for local brokerages) does add up and can eat into your returns.

Tiger Broker Referral Code:: GPE59H

I would like to invite you to start investing with Tiger Brokers so you can claim your welcome bundle.

Sign up here.

FSMOne.com

Typically I use FSMOne.com to invest in funds & ETFs (including money market funds).

If you do not have an account, you can sign up here. Please use my FSMOne referral code: P0031127, when you sign up.

Wise Card

Traveling overseas? The Wise card lets you spend money around the world with low conversion fees and zero transaction fees. Please use my referral link to sign up for one.

Shopee

I have been using Shopee for a while and think you will like it as much as I do.

Get $10.00 off your first purchase using my code DARREB52.

Download Shopee now and enjoy hot deals at the best prices! Click here.

Happy shopping!

Gemini

As stated by MoneySmart on Jan 22, if you’re looking to optimise trading your crypto with relatively low fees, simple-to-grasp expert UI and ease of purchase with Singapore dollars. then the best crypto exchange in Singapore is Gemini,

If you do not have an account, you can sign up here using my referral link. After you have signed up, once you buy or sell US$100 or more (or 100 USD equivalent of your domestic currency) within 30 days of creating your account, your account will be credited US$10 (or 10 USD equivalent of your domestic currency) worth of bitcoin.