This is just an update on my monthly passive income.

“Being Able To Grow Old Is A Fortunate Thing” Jackie Chan, 70

I think as we inch closer to retirement, it is important to consider the following:

1) Passive income cash flow amount,

2) The stability/predictability of these cash flows,

3) Allocations into different sectors so as not to miss out on any future growths and to spread out the risks.

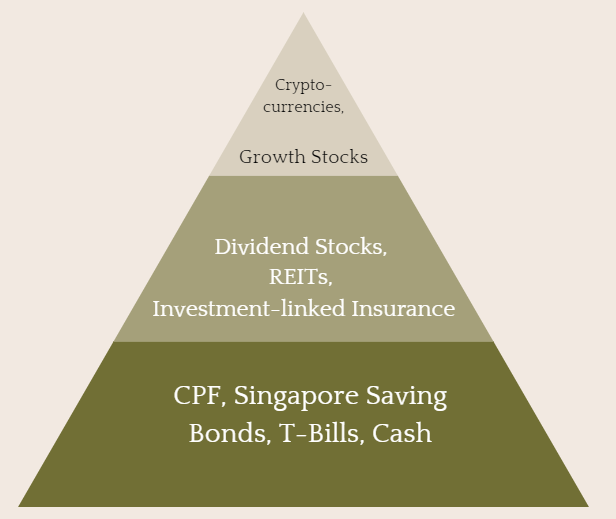

In terms of stability of cash flows, we could visualize our funds in terms of tiers in a pyramid, with CPF/Singapore Saving Bonds/T-Bill as being in the lowest tier forming the base.

This post is more related to the second-tier investments i.e. REITs, Dividend stocks. And a bit of the Singapore Saving Bonds at the first tier. If I may stretch it a bit, the selling of options of the growth stocks in the third tier.

Some people prefer to refer to these as ‘taps’.

Golden taps are like those assets at the lowest tier i.e. CPF, SSB, T-Bills, and Cash.

Silver taps consist of assets like Dividend stocks, REITs,…

Copper taps consist of assets like Growth stocks, Crypto, etc. You get the picture.

Perhaps the article below said it best and I quote: “The goal of retirement plans should be providing income to those no longer working, not accumulating wealth for those who still are.”

Wall Street Just Doesn’t Get Retirement (read here)

Or even if we are not aiming for full retirement, having another stream of cash flow might just let us ‘Live earlier” to attain FILE.

The Difference Between FIRE and FILE (and Which Is Right for You) (read here)

Personally, I always felt that there was another younger version of myself who is also contributing to my retirement ‘pot of gold’. As much as I focus on my active income via my job, I would also spend my spare time growing ‘my other self’.

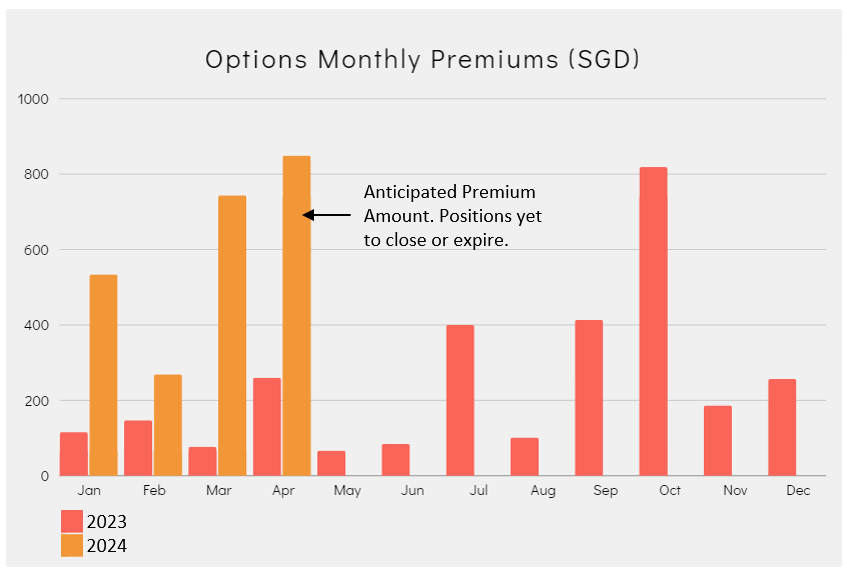

Premiums from Selling Options

Technically not exactly passive. Nevertheless, shall do a short update here.

The month of March has been rather uneventful. As anticipated, on 20 March 2024, the Federal Reserve held rates steady and stated that it would maintain its policy rate in a range of 5.25% to 5.5%. The March decision marks the fifth consecutive meeting at which the Federal Reserve (Fed) has opted to hold interest rates steady.

In addition, all my options positions’ durations did not overlap any of the respective companies’ earning calls. Thus, there were no unexpected price volatilities due to surprise earning reports. Premiums from Options for March came in at around S$744. So far, comparing each month’s premium amount, there are improvements YoY.

So in general, with an uneventful month (March 2024), all my option positions expired as planned.

Nevertheless, during the uneventful month of March, I came across this funny quote (and for the year so far) for me: ‘We are not gangsters, we are ACS boys’.

On another note, if the unexpected happens, and my call options or put options are exercised, it may actually be a good thing as they really have far-out strike prices. Often way above or below my average purchase prices (for the call options and put options which I have sold respectively).

The next Federal Open Market Committee (FOMC) meeting is scheduled for 30 April to 1 May 2024. All my current option positions that expire in April would have expired by then, except for a couple of positions that straddle into May 2024.

Still, the general consensus is that the Fed will not cut rates so soon. The US economy and inflation are still too strong for the Fed to cut rates within the next few months. Inflation is still well above the Fed’s 2% target.

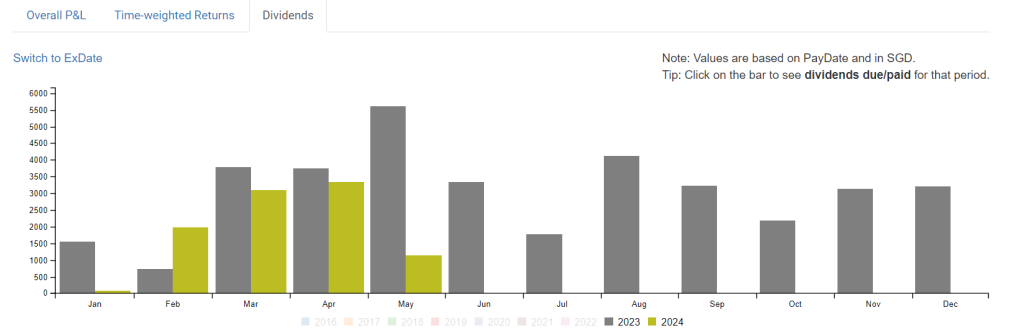

Dividend and Bond Interest Income

While for the Option Premiums, the monthly amount seems to be improving and seems to be in line with my financial target for 2024. Dividend and Bond interest income is another story.

‘My mistake was the complacency to think that this will last forever,’ Joseph Schooling

Looking through the dividend and bond interest income payout chart in my StocksCafe account, it seems that 2024 will be a difficult year for this section of my passive income. The monthly amounts received in January, March, and April 2024, are lower compared to the amounts received in the respective months in the previous year, 2023. This is despite the boost in dividend payout from DBS in April 2024.

As mentioned in my previous post, given the geopolitical risks for China/HK stocks, the persistently high-interest rates, and the forex volatilities, many dividend stocks in my dividend portfolio have lowered their dividend payout this year.

“Interest rates are to asset prices, you know, sort of like gravity is to the apple,” Warren Buffett

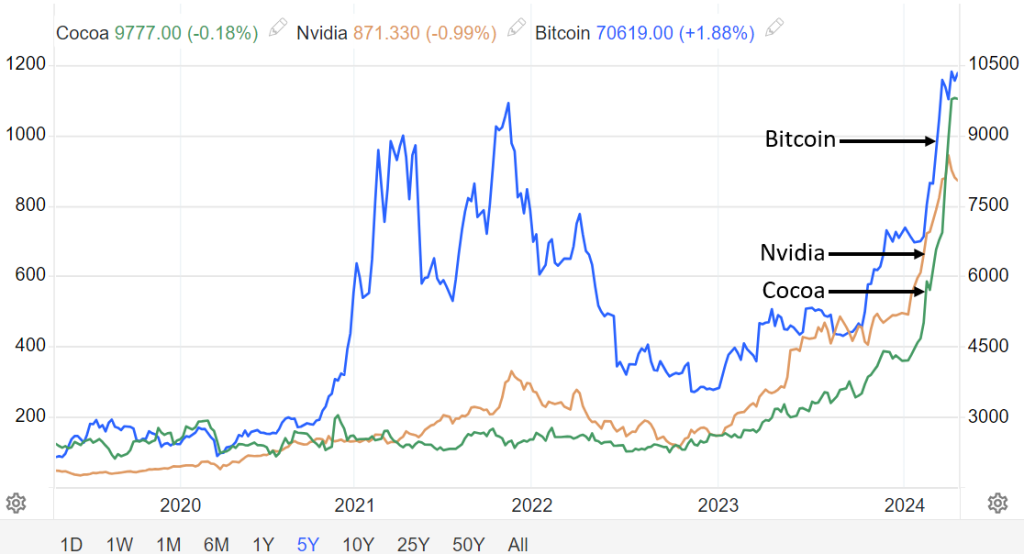

If interest rates are like gravity, then it seems that a few of the cash-rich magnificent tech stocks that are always in the limelight, crypto-currencies (i.e. Bitcooin) and Cocoa, have somehow managed to blast off and escape its pull.

Stacking them up…

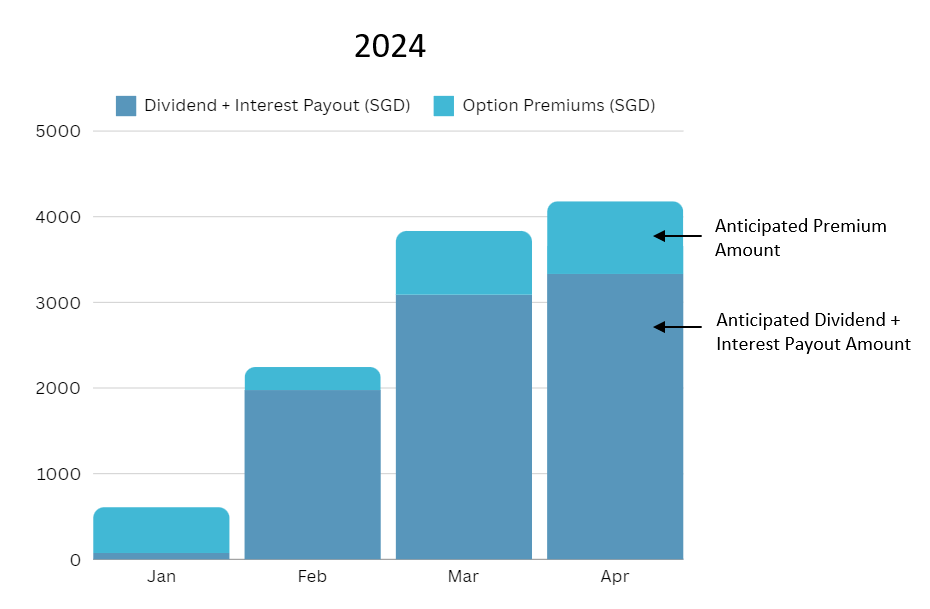

A quick tabulation below shows my passive income so far (well, exclude CPF, T-Bills, Insurance, etc). If all things go as planned, in April 2024, my passive income would have crossed $4000. In March 2024, it came close to the $4000 mark.

Perhaps they could have this feature in StocksCafe, whereby the monthly premiums and dividend payout are stacked up in an easy-to-read bar chart.

Thank you for reading.

Webull

Sign up for a Webull account via my referral link and get up to $2,500 worth of Tesla shares.

StocksCafe

FYI I find StocksCafe useful for the tracking of my own portfolio, and I especially like to use it to track my portfolio stock dividend/bond interest payouts (projected and due). You can use my referral code: apenquotes. Just click here. Upon signing up using the referral code, you will get to enjoy being a Trial Global Friend of StocksCafe and test out all features for free for one month!

Please follow me at StocksCafe, via my StocksCafe profile page.

Tiger Brokers

For the Singapore market, Tiger Brokers currently waive the minimum fee and only charge a 0.08% trading fee. This drastically reduces your cost as the minimum fee from other brokers (ranging from SGD 8 such as FSMOne and SCB, to SGD 25 for local brokerages) does add up and can eat into your returns.

Tiger Broker Referral Code:: GPE59H

I would like to invite you to start investing with Tiger Brokers so you can claim your welcome bundle.

Sign up here.

FSMOne.com

Typically I use FSMOne.com to invest in funds & ETFs (including money market funds).

If you do not have an account, you can sign up here. Please use my FSMOne referral code: P0031127, when you sign up.

Wise Card

Traveling overseas? The Wise card lets you spend money around the world with low conversion fees and zero transaction fees. Please use my referral link to sign up for one.

Shopee

I have been using Shopee for a while and think you will like it as much as I do.

Get $10.00 off your first purchase using my code DARREB52.

Download Shopee now and enjoy hot deals at the best prices! Click here.

Happy shopping!

Gemini

As stated by MoneySmart on Jan 22, if you’re looking to optimise trading your crypto with relatively low fees, simple-to-grasp expert UI and ease of purchase with Singapore dollars. then the best crypto exchange in Singapore is Gemini,

If you do not have an account, you can sign up here using my referral link. After you have signed up, once you buy or sell US$100 or more (or 100 USD equivalent of your domestic currency) within 30 days of creating your account, your account will be credited US$10 (or 10 USD equivalent of your domestic currency) worth of bitcoin.

Hi Apenquotes,

Thanks for sharing your financial journey,

Looking at some of your articles, I can resonate with some of the thoughts such as second source of income besides active incomes, mid-life crisis/awkward age at 40+ and financial burden to support young and old in the family. Although I am younger than you for few years, I can already understand those and always prepare myself mentally and financially. I am glad that there are so many “seniors” I can learn from such as you, Kyith and others.

You shared a lot of in terms of your yearly dividend incomes, actually do you mind to share what’s your expenses look like and your target numbers to achieve for your retirement. I reckon you have a daughter just turn P1 this year, perhaps your expenses might be on the high side given those enrichment/tuition expenses in addition you have another son, who might have enrichment/tuition too.

In terms of your investment/trading, I totally agree that needs to have distinct mindset to do dividend investing and option trading. As you are started to gear-up hope that to have more option generated income, it’s always need to think of risk first rather than profit first. I have been in fx/commodities trading for few years, went through beginner mistakes and able to embrace it psychologically and have the right mindset and expectation. I explore option trading previously, discussed with friend who actively doing option trading and see someone who shared option trading, there is a potential huge downside timing for sell cash secured put/covered call is during a particular stock went down hill or market crash. How would you face it psychologically?

LikeLike

Hi KK,

Thank you for your questions. Thanks for pointing out some items.

1) Yup. I am in the sandwich generation, and need to support my kids and my aged parents.

2) Expenses. To be frank, why I do not share my expenses in my blog posts is because I do not really track them.

I have only recently sign up with a personal finance app: Dobin. It helps to manage my money & save on everyday purchases. If you have yet to sign up, you can download the app here: https://www.dobin.io/download

PS: Can use my referral code when you signup: LNPKMFS

I have 2 kids. Yes my girl is in P1, my boy is in Secondary school. My girl has swimming lessons and phonetics tuition My son has mathematics & science tuition.

Every start or end of the year, we will pay for their insurance policies’ premiums, a few thousands (in top of our own policies’ premiums). If I don’t consider these.

Then my monthly expenses to my family (including kids’ enrichment) and parents’ allowance, utilities bills, to town council, food is around $2100. That is the base per month (although for parents’ allowance I give as a lump sum during CNY for the whole year, but will count that in, in ). But we normally don’t use it all, so there are left over at the end of the year for paying the insurance premiums.

If there are birthdays or anniversary, gifts, trips to the zoo, bird park…. I will add another $100 to $300

My own expenses are around $300 to $500 per month.

So if I am to guess, in total, per month, the expenses ranges from $2400 to $3000.

For another blogger – Happy Reit Investor, if I remember correctly his expense per monthly is around $5000+.

For me, at the back of my mind, I reckon my passive income from my dividend (average per month) can cover my expenses. So I can use my active income to invest.

My wife is also working, so also contribute. When I was much younger, I tried to practise the concept of paying myself first and invest before spending. But it may cause friction with my wife, so these days, I loosen up more. As long as the expenses are well covered, I don’t track as much.

3) Well, as mentioned in my earlier post, if I am to do covered options (backed by assets), my premium per month should be in the range of $200 to $400 depending on the market volatility.

So far I do some naked options to achieve higher amount.

Let’s take the example of Alphabet. If we look at the past 1 year chart, when prices are at the most volatile, in a 1 to 1.5 mth duration, price may spike up or go down max 23 points. So if I am to sell options, I look at the price now which is now around $158, I will sell call options at strike price of $188 or put options at $128 with durations of min 1 mth (to 2mths). Basically a price gap of $30. I may not get any orders, depending on how volatile markets are that day. Then I will try the next day. I mighty get lucky that night and my orders are filled. So that is my covered options. Typically these are my higher premiums options since the durations are long.

So after a few days and weeks, Alphabet stock price may trade lower or higher than $158. So maybe after a few days or weeks. Price is now at $148. Then my put option at $128 strike price may seems a bit off. I may sell naked put options of $118… shifting the goal post further with shorter duration. I am fine if my original covered call option get exercised.

You are right there are risk – huge since options are leveraged. More so if they are naked.

Hence,

a) I don’t really sell naked options, and if I do the strike prices are even further than my covered option strike price. And it really depends on the volatility… some days / weeks my orders don’t get filled, so that be it. Or the premiums are just too low to be worth the risk.

b) As you can see my strike prices if already considering the worst price swing in a given year (typically due to their earning surprises – which I try Not to straddle the option duration across. Or in the case of Alphabet, due to their blunders in AI related matters/Gemini).

And these strike prices are typically way below or above my average purchase price for my holdings. So even if the covered options are exercised, for call options – I managed to sell at a higher price from what I bought, or for put options I managed to add more to my holdings at a much lower price.

These are stocks I want to own in the long term. So for stocks which were exercised and sold, I may wait and buy back later.

For the low cost Tiger brokerage, if I do not have the money to purchase the stocks (that are exercised) or I do not have the stocks which are sold…. I would have a negative figure in my account. I reckon I need to pay interests on these / or for stocks sold – it is like I am shorting the stock (since I do not have any stocks to sell); I can continue holding these for the long term, and if price go down I gain. Still shorting stocks are not advisable, so must cut losses after certain amount.

There is also the risk markers in the account, which is based on how much holdings I have vested in that account. I try to keep it within the moderate range.

So for the option premiums income section unlike my dividend income is not very predictable.

Thanks for reminding, I need to cut down on naked options.

LikeLike

Hi Apenquotes,

Thanks for sharing further.

2) $2600-$3000 (your contribution) for family with 2 kids consider very low. I presume your mortgage is fully paid for and you don’t drive? My own contribution to family and include my personal expenses around $3500 for family with 1 kid, without including mortgage, and I don’t drive.

3) I’m not expert in options trading by all means, however, all trading in nature have something in common which is risk management. Rule #1 always take care of the risk first and set stop loss and if a risk of single trade is too huge regardless of how small the chance is that potentially wipe out/ decrease your portfolio substantially, it must not take it or even attempt it. For example, sell naked call has unlimited risk even it’s a stable company like google/apple and you try to avoid earning call/FED call, it’s possible to have black Swan like the market suddenly down by 20%-30% a day or the company is being hefty fined by regulation causing price drop significantly, and naked call can cause you lost more than your capital because there is leverage involved. By all means, I didn’t intend to stop you from options trading although I am not expert, just sharing my observations and my experience as trader. In addition, have you considered what will you do during market crash and your buy price is at high side, would you still continue to sell covered call?

4) Based on what you mentioned in the article your portfolio dividend yield is about 5%, means your dividend portfolio should worth about $720k. Assuming your option trading portfolio should be a separate portfolio, guess you should at least $1mil portfolio value excluding cpf part also, should be able to live comfortably for your retirement later when your daughter grown up.

LikeLike

Hi KK.

2) Yup, I don’t drive, and we have fully paid off our HDB mortgage. Well, it is an estimate, I know it increased with the high inflation after the pandemic.

3) Yes, if there is a black Swan event, there will be negative cash figures in my brokerage account.

If there is sudden volatility downwards, I will probably pause selling covered call options, more to selling put options. And maybe I could finally buy the growth stocks I have been eyeing for a long time.

Agree with your point, risk management is very important.

4) I don’t invest using my CPF. I only use my CPF OA fund to buy T-bills.

My total dividend portfolio + story fund value is in the high 6 figures. Ur guess is close but I rather not disclose since it fluctuates a lot.

I sell options using the growth stocks in my story fund. Had bad experience selling options using HK listed dividend stocks, they are illiquid and premiums are low. Just not worth the risks.

LikeLike

Yeah, you have more than enough assets to generate the passive income given your low monthly expenses, in addition, you will have CPF payout at age 65 onwards. Just my 2 cents and not worth to take such a big risk especially naked call/put. Looking forward for more sharing.

LikeLike

Hi Apenquotes,

Mind to share how you manage to accumulate such a huge sum of portfolio?

Is it due high income & high saving rate, portfolio good performance and compounding or combination of both?

Interested to learn more from you.

LikeLike

1) Definitely not high income. I am in the construction sector as a professional but this line does not pay well. I am not in Tech or Finance.

2) If I am single, I would probably be as good a saver as Kyith.

But I am married, so I must consider the wants and needs of my wife and kids.

On weekends, we occasionally eat in restaurants, but most of the time, we eat at food courts or Hawker Centre. It was even harder when the kids are babies or toddlers, my wife is paranoid about dirt and germs, and obsessed with cleanliness. So for year we only ate in fast food restaurants and restaurants when we eat out with the babies/toddlers.

My wife likes to travel and don’t believe in budget airlines esp with kids… so every year I set aside a sum.

When I start to focus on saving for investments, I think overtime I kind of know which area I would want to spend more. What matters most to me and what brings me the most benefit / joy. It is like going on a long trip and I am forced to only choose 3 or 5 things to bring with me (a minimalist mindset).

For example, my focus now is on health. So I spend more on hydroponics veggies rather than Malaysian veggies with all the pesticides. I rather eat cai png than restaurant food with all the sauces, vegetable seed oils. I rather go swim then go shopping. I spend more than others on whole food like avocados, papaya, geek yoghurt, chia seeds, flax seeds etc…

But in the end, eating healthy is not that expensive. It is a different story if I prefer the joy of driving a car.

I don’t spend much on clothing and transport as they do not bring we as much joy and benefits. If I can use Grab or Taxis. If I really need a car, I can rent.

There was a time my wife laughed that her husband only have 5 to 6 shirts in my wardrobe and 1 pair of office shoes, and I wear them every week to work. By the way, I have more sets now. She also laughed that her colleague who dressed more shabbily walked to a BMW after work, while me in my nice office wear walked to the bus stop.

I was a hard saver when i was younger but this cannot be compared to if I am a single guy.

I guess it also help that I have 2 siblings and my parents have an investment property, so I don’t have that much financial burden (yet) to care for my parents.

I never had a car, bought a BTO near my in-laws, don’t have expensive habits. Went overseas to work for around 1.5 yrs after I graduated to pay off student loan from bank, then get married.

3) My investing journey is filled with wins and losses. But I always held on.

I tried other things often with no success,, if u read my blog. I tried p2p lending, amazon selling by fulfillment, even at one time went around looking for startups to Angel invest.

I wasn’t that much into dividend investing until maybe 2018 or 2019. I started with growth stocks listed in Sg. I guess when your vested amount is not big, dividend payout is insignificant.

Some of my good picks then were Supergroup and Nirvana Asia which were both delisted and bought over. Also had big losses like SIA, Golden Agri, Sarine Tech. So not a lot of big wins, but I reckon it instill in me the discipline to save and invest, and keep a large part of my savings (even if my investment did not do well- portfolio value just kind of equal to what I put in).

But overtime, I kept adding on to dividend stocks to keep compounding. Dividend kept coming… Looking at the companies, their fundamentals are not as good as growth stocks, but since by then I have around 6 figures to invest, the annual dividend isn’t that small also. Well small 4 figures per Yr.

I still like to check fundamentals and narratives and invest in growth stocks but I tend to wait for crashes then invest since I always feel that they are overpriced and I don’t get paid dividend for waiting.

Early 2019 onwards invested a substantial amount in HK stocks (dividend + growth). After the HK riots. Bad bet then was Alibaba.

Late 2019 to March 2020 after, covid crash helped, invested another substantial sum, in local dividend stocks and US growth. DBS, Alphabet, PDD are some of the better performers. Some 2x vested amount.

Not sure how I can help. Hope u find this useful.

LikeLike

Wow, thanks for sharing such a detailed journey.

When I read your saving journey on a daily basis, I can see myself in my mind too. I am also a minimalist, having limited set of office clothes back then and most of my clothes bought by my wife and she forced me to throw some of the old clothes which I think is okay to wear. Yeah, I have only 1 pair of office shoe, sport shoe and a sandal and I am also not a foodie person, cai png is good enough for me. My wife also has very different perspective towards money management and she is a foodie person and would like to try new food and my daughter has food allergy towards egg and seafood since very young, hence, her food option is very limited and skew towards fast food and budget restaurants (e.g. saizeriya) and food court at shopping mall.

I didn’t track my expenses and wealth back then until this few years, then I only realize my wealth and my monthly expenses (rough estimate) and then plan for my retirement accordingly. I bought my first resale hdb at peak cycle and it’s almost 30 years old already, hence, it’s a losing trade when I sell and moved to EC. Currently, the EC has appreciated quite a lot, and hopefully when the profit can help to payoff the HDB when I decide to downgrade in few years time.

Yeah, you are considered a lucky man that you don’t have much financial burden and you have parents and parents in law to help to take care of your children.

In terms of the investment/trading, I also don’t know much and a hopping here and there with no luck and also lose some amount of money, but I know I must do investment as I believe I need to have second source of income on top of the active income because I read rich dad, poor dad book during my A level time. Few years back I also actively searched for holy grail forex trading strategies and finally I come to realize there is no such holy grail, and every trading strategy has its strength and weakness depends on the cycle. I then chance upon rayner teo trend following strategies and also do some research and have faith that it’s working long term while can help to reduce risk although the return might not as high as other investment. Over the years, I also diversified into other strategies such as SRS goes into endowus robo, another trend following index fund and recently will put some fund into Reits/Banks. With these strategies in place, hopefully, can help reduce the drawdown of my portfolio. If you can see above, my portfolio heavily into trend following with proper stop loss in place, however, no stop loss allocated for endowus robo and Reits/banks portfolio.

Yeah, definitely agree with you that health is the most important thing physically and mentally. I do practice some exercise daily at home such as stretches , bell lifting and sit up, eat some supplements, sleep before 12am (sometimes will sleep around 10pm). I didn’t pay too much into food choices but do try to avoid too salty or sweet stuffs and will still take coke/100-plus occasionally too.

Do you have any plan for retirement like when and what you wish to do? Not sure if it’s because of too much workload for my work, I sometimes will think to resign and retire, but I have a daughter aged 12 and still have about 11-12 years to graduate from university and enter workforce. Until then, I am considering to change career with lower salary with managed workload (hopefully though I know it’s not easy). After retirement, maybe I’ll go to Malaysia more frequently (ya, I’m from Malaysia but converted to Singapore citizen) to meet my old friends and slower space. But my wife has a list of travel plan, but I’m not sure if the retirement fund is sufficient. I know very sure my retirement fund is sufficient for me alone as I am a minimalist and doesn’t have much wants (aka a very boring man). haha.

LikeLike

Oh my wife can be quite picky with food. She would not want to go Saizeriya or into budget restaurants. But luckily we don’t often go to restaurants. So basically, it is hawker centres, food courts, fast food or restaurants. Me not too fond of fast food though.

Well, it is good to explore different ways to invest/trade. We are all different, if it suits you and works well for you, that is great.

On trading – I think it took up too much time, so did not really go into it.

Health: Well, think u are already better than most people (who don’t even exercise). Actually the thing that is more important is what we don’t eat. We can eat very good food, but if we ‘pollute’ our gut with junks then it is just gonna kill all the microbiome. By cutting down added sugar, vegetable seed oils / fried food, dairy.. it would already help a lot.

Actually, some questions if you do not ask me, I would not think about it.

I recently changed job, hoping for lesser work load. So far, though it is still too early to tell, the environment is better. In my previous job, after the re-opening, I was promoted, but the pay increment was very little ($200), but the workload increase was much more and there juniors helping are also overloaded (from other more senior staff). As we get higher in the ladder, more and more things are beyond our control (I feel). Or put it in another way, I just felt to earn that $200 is not worth it, there are easier way for me to earn that amount per month.

I am not sure if you have read one of my earlier post: https://apenquotes.wordpress.com/2020/11/07/singapore-investor-bloggers-with-min-1-sgd-million-stock-portfolios/

In it, there is a blogger Chua Ghim Hock from My Investment Portfolio. In his blog landing page, he mentioned: “Why I left engineering/IT: I didn’t leave because it was hard. I left because it was no longer worth it.”

I think if I can generate sufficient passive income that far exceed my needs and what my salary can generate, then it is time for me to leave my job. Kyith previously mentioned about those with such big portfolios that can generate 3x their needs/wants are pretty safe (from recession, market downturn, dividend cuts, etc). I wonder how it would that feel like if I ever reach that stage that Ghim Hock was when he left his job.

I guess there are pros and cons to converting to a citizen (instead of a PR). Perhaps easier to buy HDB/EC and no need to pay ABSD (am not too sure). But one of my younger colleague chose to remain as a PR here. Think it will be easier for her to go back to Malaysia (and buy property etc) I reckon.

I would like to retire in Malaysia too, but unlikely wife would like to follow me (she wants to meet friends/ children here). Well, different people different strokes.

But just felt that Singaporeans are rich, but have nowhere to spend. Prices are inflated or taxed.

LikeLike

Health: I just remind myself to control sugar, but I continue to eat the food I usually eat and my daughter like fast food like Mcdonald’s, A&W, maybe once a week and I just follow, not super conscious or cut down completely. My wife boils soup some times if she not too busy with the work and cook some simple dish.

In terms of trading, I am a systematic trader. Usually I spend only about 5minutes daily to trade with pre-defined rules and another 30minutes once a week to re-adjust my stop loss. This is my main portfolio. For other portfolios which are etf/index trading, it takes only max 10 minutes a month, so it’s not time consuming as you expected. However, it takes time to find a strategy that fit us. Yes, totally agree with you that we must have faith on a particular strategy and it must suit us either fit into our schedule or mentally.

Work wise I totally agree with you as we grow older and higher in the ladder, a lot of things are out of our control. Yeah, it not worth it at all with additional responsibilities with merely $200 increment. However, if there is no other offer that time, guess have to suck it up too as we have family to feed. I believe your skillset is on demand, hence, you are able to find the job quick fast. The field – data analyst I’m currently at is very competitive, as government has promoted very aggressively so a lot of freshers and talents overseas.

I look at Ghim Hock’s blog and he seems inactive already. 3x of the needs?? erm… This will requires very large capital, don’t think can retire already.. I think 1.5x of the needs still achievable from my point of view. Personally, I’ll consider my daughter graduate from uni which is in about 10 years times. By then I can choose the task I like to do without needs concern too much about financial.

I convert mainly because my daughter study in SG due to better education system and differentiated approach by government too. Not much different after convert to citizen, I can still stay in Malaysia for up to 30 days.

No doubt, Singapore is a good place to work and save money. In terms of retirement, I would think there is other place, not necessary Malaysia as long as it fits into the retirement budget.

LikeLike

Well, pertaining to investing and trading. Yup if it works, it generates profit and income, stick to it. Hone on the skills and grow the profits/income. One does not need to be doing many different things to earn, as long as one is good at something.. even if it is just dividend investing. Just slowly building up, little by little, he/she will get there.

One thing I like about dividend investing, it helps to divert attention away from the stock price. If it is with price of good companies/REITs, the lower the better, the higher the yield. It is more on fundamentals and income.. which I think is more important. So it is also why I did not post my net worth, and my blog posts are typically about the companies and income.

Data Analyst is the hot sector isn’t it. Especially during the pandemic and tech sunrise sector. Well I am sure it is in hot demand and the salary is up there.

My skills are in the construction. Not the sunrise sector. I am just glad to get a normal job. Have some time to myself, and do some side income. Sometimes when it comes to a job, many things are beyond my control. Just keep my head low, do as much as I can. My job change was a big step for me actually. I have been in my previous job for around 18 years. So it was quite scary. But the firm was bought over a few years before the pandemic, management just changed.. and new management didn’t know how to manage. I wasn’t growing there as well… so it was time to move on. But once I got over it, I realized it wasn’t that bad. It helped that I have savings and passive income, my wife is working too, kids are healthy, and my parents are not that dependent.

It is good if you can find a company that is willing to grow you. My previous company wasn’t like that and perhaps nowadays, more and more companies don’t really care. They care more about their bottom line. Well, if it is like that, then create your own destiny. Think of life as a series of poker card games, you get issued a set of cards every game, some good, some bad. You can choose to close the bad ones and move on. Play on with the good cards. Life is unpredictable, just create your own path.

Well, of course the end goal is when our kids leave the nest (if they ever do, when it is common nowadays to not get married and birth rate in Sg fell below 1 for the first time). Well, I see myself slowly not being dependent on my salary, year by year. Perhaps one day, if I ever get retrench (won’t be surprised with how it is in Sg now), then I can pivot to do something else. Sell insurance, real estate… give tuitions, set up a YouTube channel hahahha…no idea.

Actually in my that post, many of those featured (except for Kyith who is probably the younger one there), most aren’t really active in their blog. Even STE now also quite few posts. AK still posting.

Lady you can be free -prob stopped posting.

They are older and probably semi retired and retired.

Well, don’t set a limit on yourself. The first 100k is the hardest, then the 1st 1 million is the hardest. It becomes easier with the snowball effect after that. Same principle bigger war-chest with effect of compounding.

A black swan may also accelerate the growth process if we are not scared out of it. After the pandemic, my net worth increased quite a bit (although a lot of my REITs aren’t doing well, still it wasn’t that bad overall).

LikeLike

Pingback: My neglected portfolio, the Story Fund | A Pen Quotes