“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” John D. Rockefeller

I am sure many are way more advanced than me in tracking their dividend, but let me share a bit about how I do it for my own portfolio.

However, before I begin, I would like to highlight that to me personally, the focus on any stock/REIT investment should not be just on or primarily on the dividend yield or payout amount. The focus should be on the fundamental of the companies (behind the stock) and industries they are operating in as well as the narratives of the business.

A long-term consistent growing dividend income (or capital gains) should be a by-product of companies which managed to increase their earnings and which are fundamentally alright.

These sites are just tools for me to track these incomes which I hope will consistently grow over the years.

1) Dividend.sg

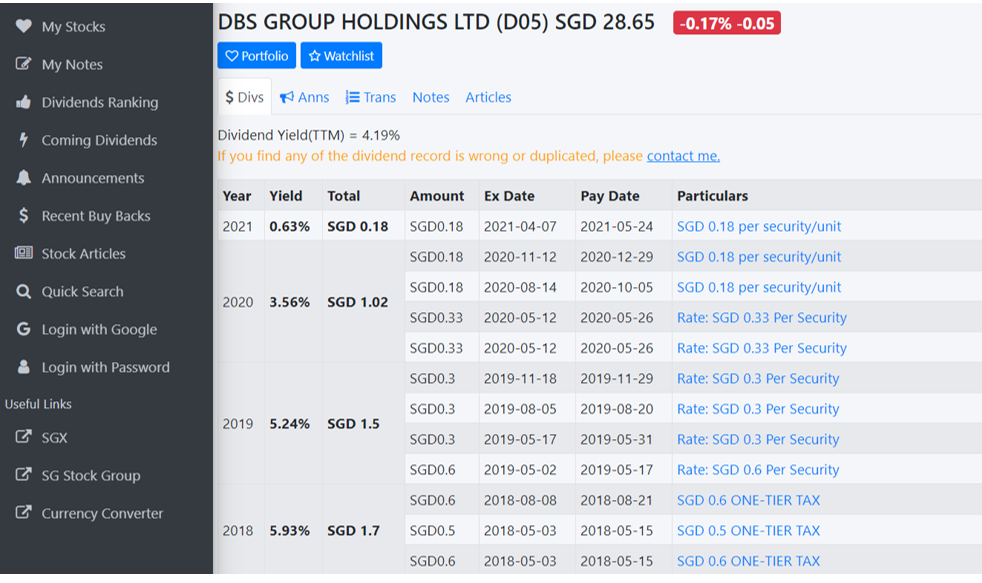

A good website to track Singapore listed stocks dividend payouts is Dividend.sg.

If I am wondering if I have missed any of the dividends of my stocks (yeah sometimes I too lazy to remember, and wonder why got a cash deposit in my bank account), I might drop by this website to check on the dividend payout dates and amount of the stocks I own.

For instance, if I am thinking about DBS, I will go to ‘Quick Search ‘and click on DBS.

It will show the ex-dividend dates, the payout dates and payout amount for DBS stocks.

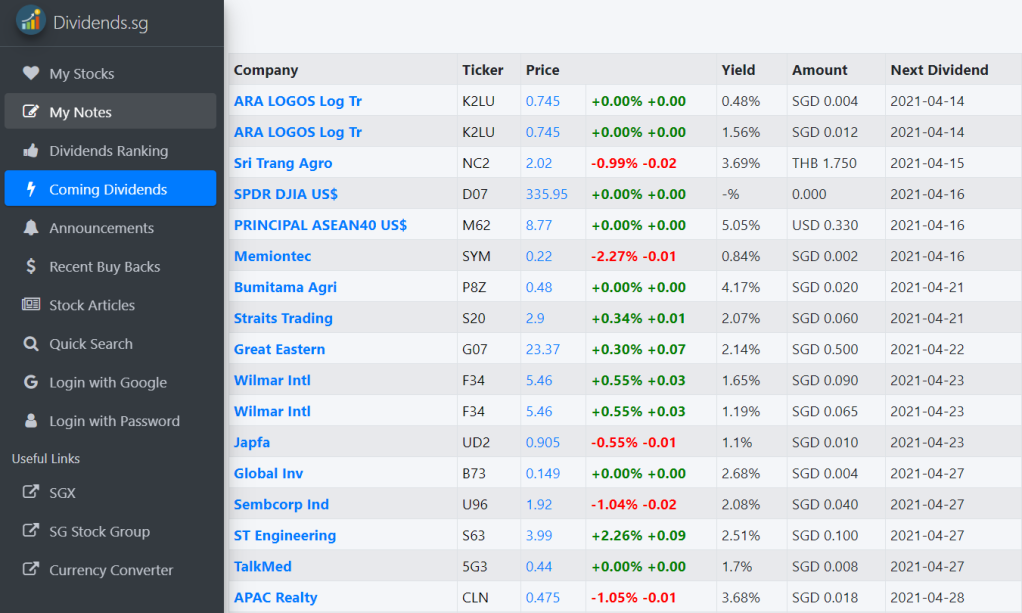

If I am concerned about the upcoming dividends for this month, I will click on ‘Coming Dividends’ to check out which counters are paying dividends for this month.

2) Investing Note

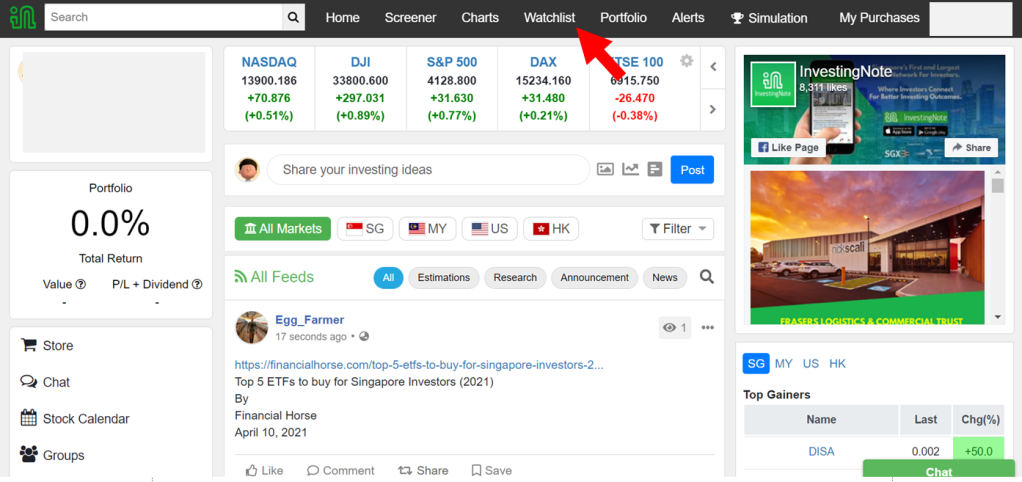

Well, I always felt that Investing Note is more of a social platform for traders and investors.

However, there is a function there for you to track the dividend of the stocks you own.

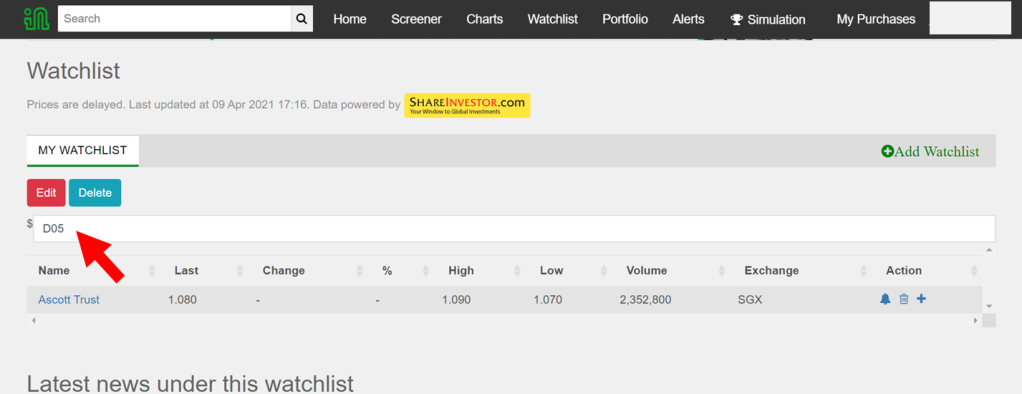

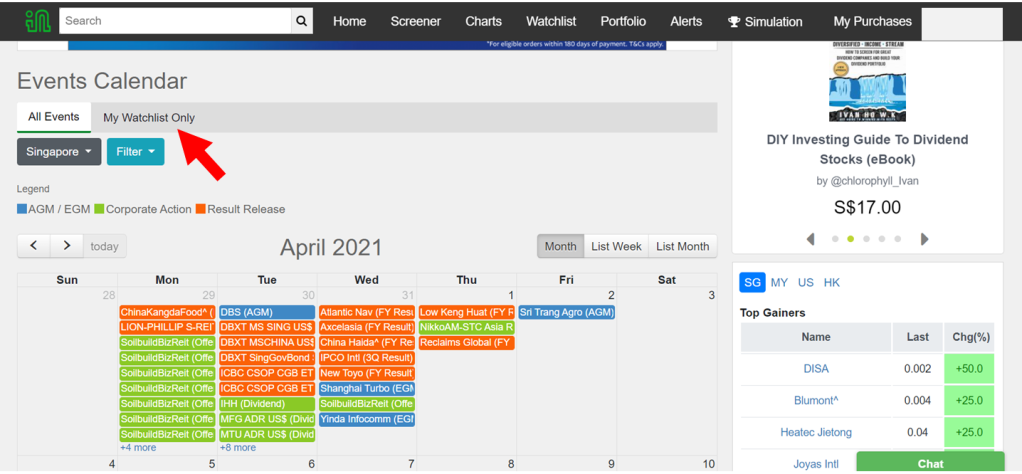

First, you have to create a watchlist of the stocks you are interested in. Click on ‘Watchlist” at the top bar. By the way, you can create new watch lists with different names.

Let’s use DBS as an example again. Add DBS (D05) to be part of your watch list.

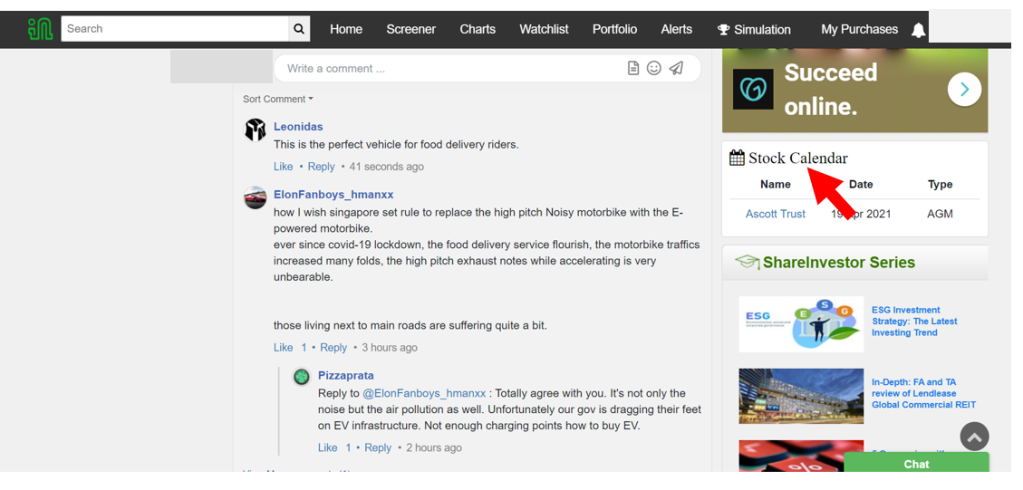

Then go back to the main page. Go to the right and click on “Stock Calendar”.

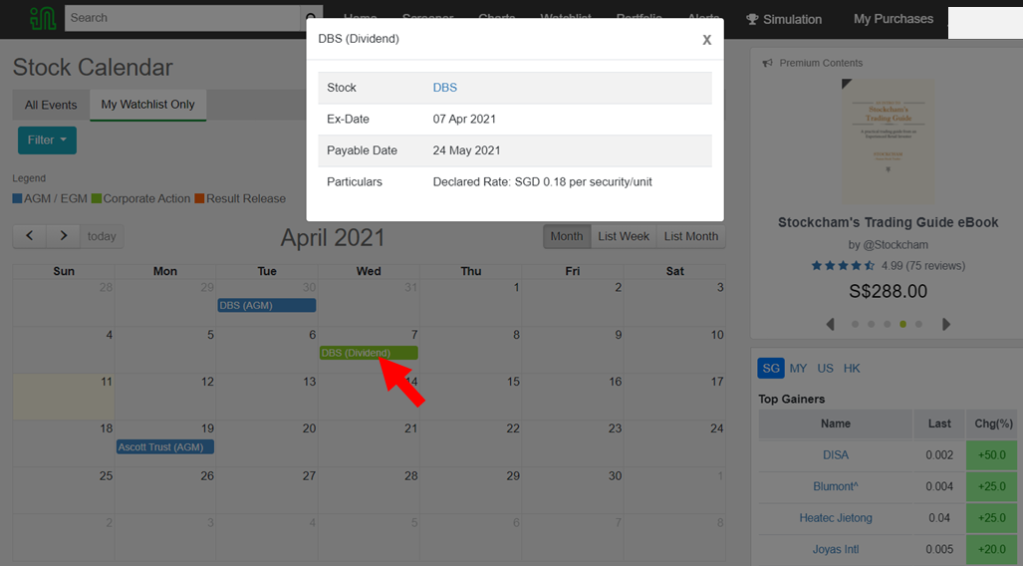

Click on ‘My Watchlist Only” or the name of the new watch list you have created.

You can view events by month, and you should see DBS dividend action in April 2021.

3) Tiger Brokers

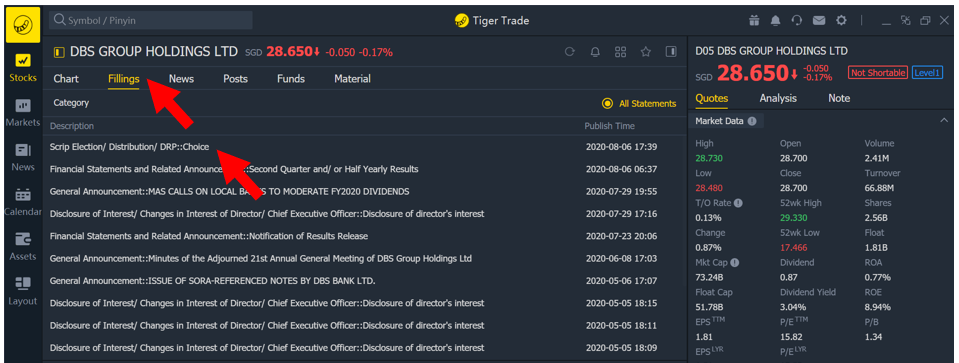

I am still new to Tiger Brokers, but this is what I have found out.

If you go to the desktop version, in the charts, there are boxes with the letter ‘D’ within as shown along the chart line (using DBS as an example again). Click on that and it will tell you the ex-dividend date and payout amount.

Alternatively, you can click on ‘Filings’ at the top and it will bring up the list of company announcement much like what the SGX Company website does and you can find the dividend payout announcement.

For the Singapore market, Tiger Brokers currently waive the minimum fee and only charge a 0.08% trading fee. This drastically reduces your cost as the minimum fee from other brokers (ranging from SGD 8 such as FSMOne and SCB, to SGD 25 for local brokerages) does add up and can eat into your returns.

Please use my Tiger Broker Referral Code:: GPE59H

Sign up here.

See below sign-up bonus:

1) Upon completion of registration, you will receive 500 Tiger Coins.

2) Upon completion of account opening, you will receive 60 commission-free trades for U.S. stocks, H.K. stocks, Singapore stocks and Futures within 180 days.

3) If you make an initial deposit more than 2000 SGD or equivalent currency, you will receive a free share of Disney.

4) StocksCafe

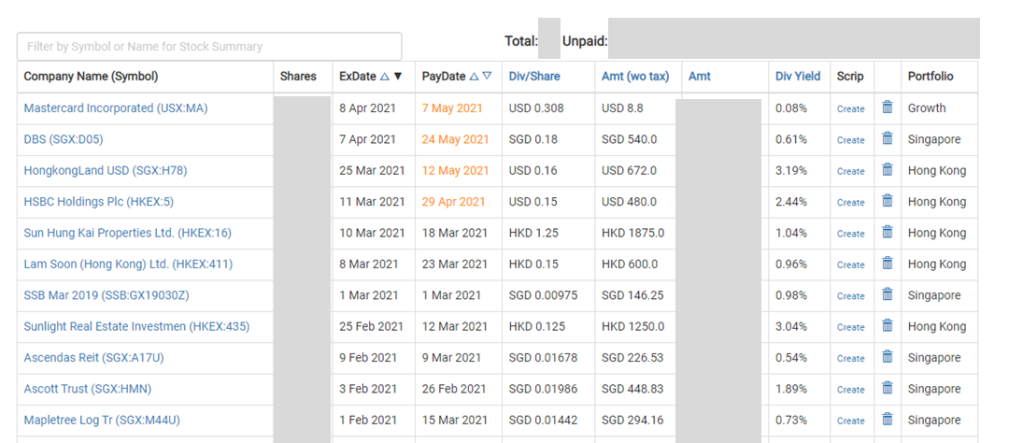

StocksCafe is by far my favourite site to use to track my dividends. With this site, I seldom use the above three mentioned sites.

First, you must first create your portfolio of stocks and bonds (number of shares/bonds and when they were bought or sold).

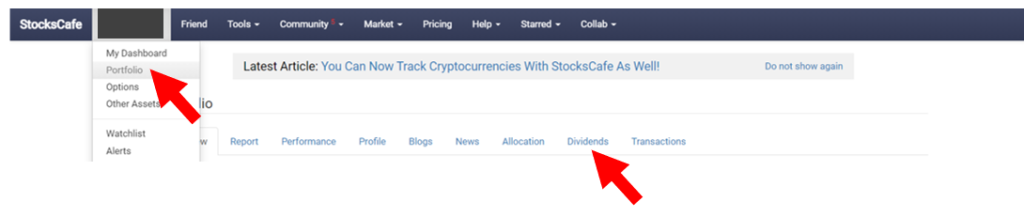

Once you have done that, it is kind of easy moving from there. Go to the top bar, under your user name, click on ‘Portfolio’ then go to the bottom bar and click on ‘Dividends’.

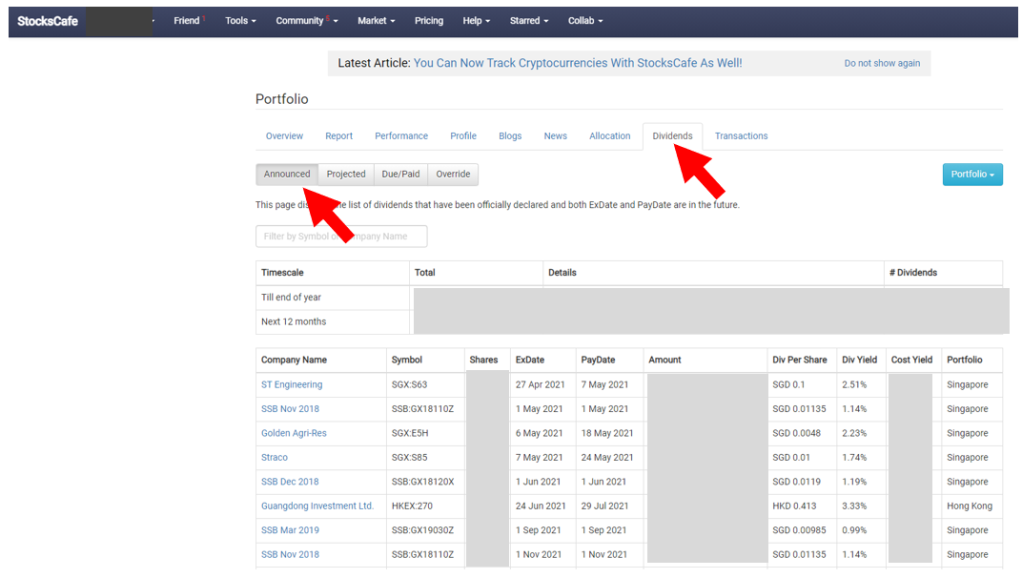

You can track the ‘Announced dividend ex-dividend date, pay date and amount’. This also applies to the interest payout from bonds (in my case, Singapore Saving Bonds);

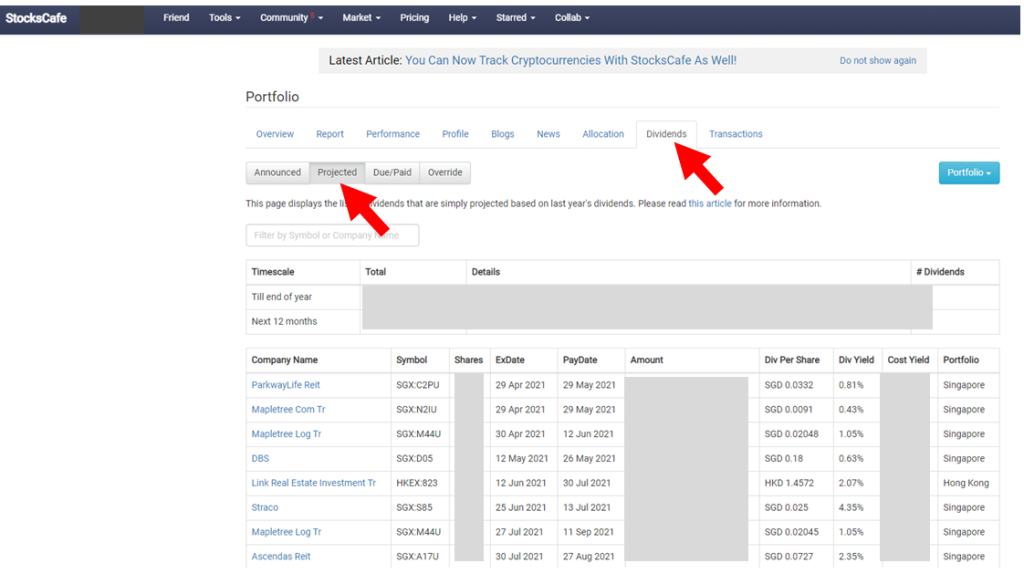

The ‘Projected dividend ex-dividend date, pay date and amount’. By the way, this may not be exactly accurate, but it does give you a feel of what you can expect for the next 12 months, and they do help to tally up the total amount of dividend based on what you currently own.

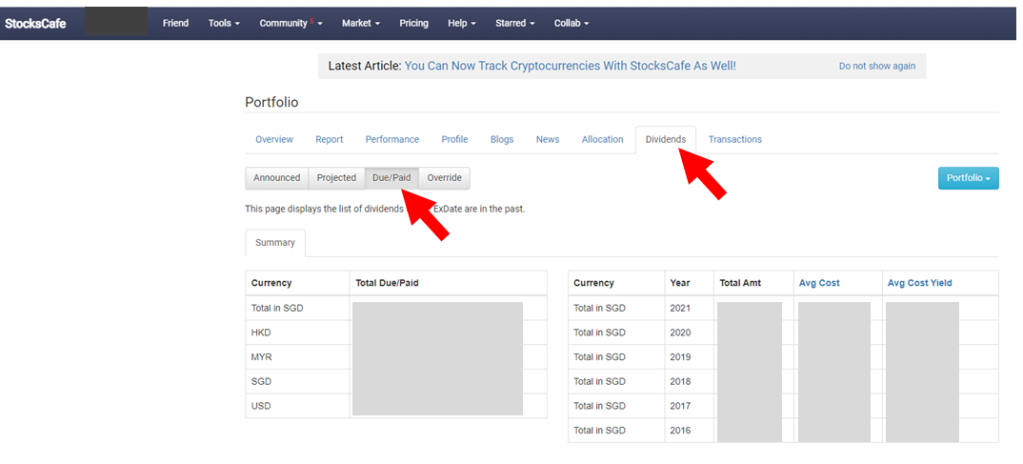

The ‘Due/Paid dividend’ page. In this page, it will show the amount already paid to you for the various years (summary page). As well as the ‘Soon to be due dividend ex-dividend date, payment date and amount’ for the various counters. Those upcoming dividend due dates are highlighted in orange.

There is also a chart that plots out the yearly dividend amount. So you can track your progress over the years.

Yes, from this page I can see the amount I have received so far; the page I like the most….Muahahaha!

I can check on the dividend income from stocks listed in Singapore and from other markets (eg. US, HK, Malaysia, etc), and then I can have an idea of the projected income for the next 12 months, and the due amount in the coming weeks. And finally, I can see what I received so far (in SGD) from the past days to the past weeks, to the past years.

You can use my referral code: apenquotes. Just click here. Upon signing up using the referral code, you will get to enjoy being a Friend of StocksCafe and test out all features for free for two months!

Please follow me at StocksCafe, via my StocksCafe profile page.

In Summary

Well, that’s is basically what I normally do. Actually there are many more sites, but these four are the usual ones I normally use.

Depending on how many counters you have, it might be more worthwhile to automate the whole process.

“Any daily work task that takes 5 minutes will cost over 20 hours a year, or over half of a work week. Even if it takes 20 hours to automate that daily 5 minute task, the automation will break even in a year.”

― Anthony J. Stieber

Let me know how you track yours, drop a comment below.

Do like my post if you have enjoyed it!! Click the star below.

Do subscribe to my Patreon page.

Pingback: Short update on Portfolio | A Pen Quotes