Just penning down some of my thoughts.

Investing vs Speculation

Ah yes, the age-old question about the difference between investing and speculation.

To quote Warren Buffett:

On Investing:

“When I buy a stock, I don’t care if they close the stock market tomorrow for a couple of years because I’m looking to the busin\ness – Coca-Cola, or whatever it may be – to produce returns for me in the future from the business.

Now, if I care if whether the stock market is soap tomorrow, then to some extent I’m speculating because I’m thinking about whether the price is going to go up tomorrow or not. I don’t know whether the price is going to go up.”

On Speculation:

“Speculation, I would define as much more focused on the price action of the stock, particularly that you, or the index future, or something of the sort,

Because you are not really – you are counting on – for whatever factors, because you think quarterly earnings are going to be up or it’s going to split, or whatever it may be, or increase the dividend – but you are not looking to the asset itself.”

It is not easy to differentiate between the two.

Well, often the first thing I see when I check my stock portfolio is the stock prices. After all, these change every day, every hour… while the business itself doesn’t change much. The returns (as in dividend income) takes a long time to accumulate.

Think of the analogy of the guy walk the dog with a leash. See explanation by Joshua Brown in the video below (fast forward to 0.55).

To quote:

“There’s an excitable dog on a very long leash in New York City, darting randomly in every direction. The dog’s owner is walking from Columbus Circle, through Central Park, to the Metropolitan Museum. At any one moment, there is no predicting which way the pooch will lurch.”

“But in the long run, you know he’s heading northeast at an average speed of three miles per hour. What is astonishing is that almost all of the dog watchers, big and small, seem to have their eye on the dog, and not the owner.”

I use this analogy all the time to help people understand how the economy and stock market play off of each other. One of the hardest things to do as an investor is to entertain two opposing thoughts in our minds at once, and find a way to keep them despite the cognitive dissonance this can produce.

One of the most ironic aspects of investing is that the greatest gains lie ahead at times when things are bad, but not quite as bad as everyone suspects, and slowly, almost imperceptibly getting better. This is the moment when assets are selling at discounted values and the opportunities are laying at our feet, there for the taking.

Conversely, the worst time to invest is once everyone agrees that the environment is terrific and that the gains will continue as far as the eye can see. It is at this moment we find ourselves paying up for assets and competing with lots of other buyers.

Psychologically, it is hard not to be swayed by the prices. Just when the Hang Seng is recovering from the HK Protests, it was hit again by the Wuhan coronavirus outbreak.

- Wuhan’s viral outbreak knocks the stock markets of China and Hong Kong off their paces, just as a rally is building momentum (read here)

I had just started a portfolio consisting of Hong Kong-centric stocks last year (prices of many stocks were knocked down then given the long-drawn protests and recession).

At one time, many of the prices of these stocks have increased beyond my purchase prices… before they were dragged down due to the Wuhan coronavirus outbreak…

Metaphorically, the green shoots were washed away by the Wuhan heavy downpour.

…and it might get much darker before we see the end of the tunnel. There will definitely be volatility.

The Lunar New Year holiday in China was initially set to run from Jan. 24 to Jan. 30, with work resuming on Jan. 31. Nationwide, the Chinese government has extended the holiday so that businesses would not reopen until Monday, Feb. 3.

- Massive sell-off expected when China’s markets reopen (read here)

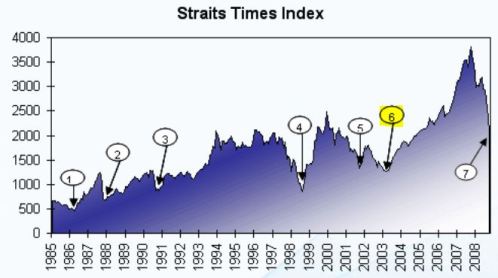

It is interesting to look back at how STI reacted in the past over turmoils. I have found the below 2008 FSM article. During the SARS outbreak in 2002-2003, the index dropped by approx. 33% over a year period.

- The Singapore Market Is Nearing A Bottom (read here)

As I looked at my portfolio (sea of red), my only thought (burning question) was……. what should I buy next for Feb 2020?

“Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” Warren Buffett

My goal was, after all, to slowly accumulate and increase my dividend income (won’t exactly call it passive). Well, stocks aren’t exactly dirt cheap at the moment, and the protests in Hong Kong aren’t exactly over. Amid the growing discontent fuelled by myriad social and economic problems, the Wuhan virus outbreak only adds to the issues.

- Wuhan virus fears become new source of unrest for battered Hong Kong (read here)

It is easy to be affected by the news. In recent days, the news headlines are nothing but the Wuhan coronavirus outbreak. Singapore and HK economy will probably be affected. And about how the stock markets are affected.

No way we could avoid the news. On a daily basis, I see more people wearing masks on my commute to and from work.

Not too long, the headlines were nothing but the Hong Kong Protests…

However, (on a long term perspective) I believe both Singapore and Hong Kong will recover.

Currently, in the Singapore and Hong Kong stock markets, many travel/tourism & leisure-related stocks, retail/hospitality REITs, transport/aviation-related stocks are looking pretty battered. Not drop-dead bargain prices though.

Portfolio

Ok, some updates on my portfolio. I have moved more of the funds from the Money Market Fund to the Short Term Bond Fund. And also added part of my bonus to the Short Term Bond Fund. Good to see regular interest payment from the bond funds (including SSB).

Given the drop in stock prices, the percentage of stocks in the overall portfolio did not really increase (although I did add small amounts in Jan). See portfolio breakdown in end Dec 2019 here.

Percentage of Stocks vs my Warchest (consisting of cash, SSB, Money Market Fund, Short Term Bond Fund) is still relatively small. It is not even 30%.

It is still in a very defensive mode. I don’t intend to go in big-time on stocks just yet. And will stick to my monthly regime of buying small portions of stocks.

I have started purchasing a small amount of Singapore listed shares (eg. DBS and Sats) in Jan. All of the stocks I purchased are giving me some sort of dividend yield.

Hence, the anticipated dividend payment is inching up compared to last year.

So far I have received the dividend for Link Reit in Dec 2019, and IH Retail in Jan 2020.

It will be a drought in Feb 2020. No dividend income except for bond interest payment. The next dividend payments will be in March 2020, from Sun Hung Kai Properties, Sunlight REIT and Lam Soon.

That’s it for now.

Pingback: Stay the path, keep investing | TheFinance.sg

I am only starting to look into HK stock but not familar with the market. Can you share with me how do you get started, is there a English portal similar to Investingnote.com or other reliable news site/bloggers you follow?

LikeLike