There are few opportunities when it is a good time to buy shares of certain fundamentally good companies. For instance when there is a market crash (bad economy, recession, etc), and when there are bad news relating to the company. In the latter case, the news may or may not materially affect the fundamentals of the company.

Chipotle’s profit tumbles after food scare (read here)

In the case of Chipotle Mexican Grill, the management said it had expected to see an 8% to 11% drop in quarterly sales as a result of the food safety scares, which started in October last year, damaging the firm’s reputation and share price. The chain is trying to bounce back after multiple E.Coli and Norovirus outbreaks were connected to the chain last year.

A food scare is a normal occurrence (although not a frequent one), and E.coli is not a new discovery. Each year, about 48 million people get sick from foodborne illnesses, according to the CDC. (read here)

In fact (in one of the articles), the firm mentioned that it was pleased to have the E.coli issue behind it and that it was now focused on reducing its food safety risk.

I believe in the long term, the food scare would be a minor blip in the performance of Chipotle Mexican Grill.

“Prices fluctuate more than values—so therein lies opportunity.” Joel Greenblatt

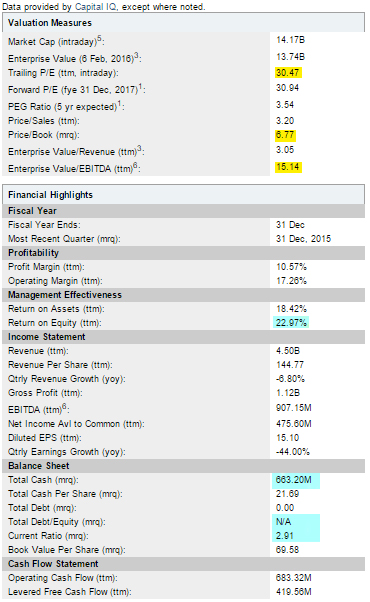

Let’s have a quick look at the financial statistics of Chipotle Mexican Grill.

The good points:

- The management effectiveness of Chipotle Mexican Grill (CMG), esp. for ROE, is relatively high at 22.97%.

- Balance sheet of CMG is very good, with a high total cash level of USD 663.2M with no debt.

- Current Ratio is 2.91 (Acceptable current ratios vary from industry to industry and are generally between 1.5 and 3 for healthy businesses).

- A search in POEMS show that the 5 years EPS growth rate is 21.77%.

The bad points:

- It has no dividend yield.

- Valuation wise, it appears that Chipotle Mexican Grill (CMG) is over-valued. A search in POEMS, shows that the P/E is 31.18, and the EV/EBITDA (as shown above) is only 15.14 (As a rule of thumb, any EV/EBITDA below 10 is the sign of a good value). The price to book value is also high at 6.77.

However, the P/E and Price to Book values had to taken in relation to their historical values (which in this case, the recent values would appear relatively low).

In addition, the ROA, ROE and ROIC all exhibit an upward trend over the years. (See below)

Free Cash Flow over the years is also trending up consistently. (See below)

In gist, good balance sheet, strong growth, and relatively low valuation (compared to historical values).

Let’s do a quick study on the trailing PEG and intrinsic value of Chipotle Mexican Grill.

1) Trailing PEG

- P/E: 30.58

- Dividend Yield (%): N.A.

- EPS compound growth rate (5 yrs): 21.77%

The trailing PEG will be 30.58/21.77 = 1.4. Which is not good (> 1).

2) Intrinsic Value

First let’s look at the estimated 5 years earning growth. We are going to use a time-frame of 5 years from now for this purpose. Given EPS and a PE ratio, stock price can easily be calculated for any company. Using the below formula.

F = P(1+R)N where:

- F = the future EPS

- P = the starting (present) EPS (15.09)

- R = compound growth rate (21.77%. However let’s take a 20% discount, and use 17.416% as I am not really sure if growth can be maintained.)

- N = number of years in the future (5)

Estimated future EPS: 33.7

I will be estimating the future PE of Chipotle Mexican Grill to be 42.86 (See below data from Morningstar) – average of the PEs from 2006 to 2015.

Future Stock Price

P=EPSxPE

- P = future stock price

- EPS = future EPS

- PE = future PE

Hence future stock price of Chipotle Mexican Grill is 42.86 x 33.7 = 1444.382

Intrinsic Value

P=F/(1+R)N

- P = present (intrinsic) value

- F = future stock price (1444.382)

- R = MARR (15% or 0.15)

- N = Number of years (5)

Hence, the intrinsic value of Chipotle Mexican Grill is USD 718.

Stock price of Chipotle Mexican Grill on 6 Feb 2016 is USD 460.14. Hence, there is a margin of safety of 35.9% (even after considering a 20% discount in EPS growth rate).

In gist:

I reckon given the strong fundamentals of the company, and the low price of the stock in relation to its intrinsic value, the food scare and bad market sentiments might present a good opportunity to pick up some of the company’s shares.

Will keep a look out for this stock. If the US market enters into a bear market, the price of this stock will be further depressed.

Shall leave you with this song is this volatile market.

“Value investing is at its core the marriage of a contrarian streak and a calculator.” Seth Klarman

Pingback: Perfect storms…. Cheniere Energy, Inc. (LNG) | A Pen Quotes

Pingback: Re-visiting Chipotle Mexican Grill, Inc. | A Pen Quotes