To be frank, what initially attracted me to the stock of Japan Foods Holding Ltd. recently, is its dividend yield. As mentioned in my earlier post, Japan Foods’ dividend yield is 4.06% in FY 2017, and it is among the highest in the consumer stocks family (if not the highest). See below.

The company paid out SGD 0.0205 in dividend in FY 2017.

The recent share price of Japan Foods is $0.505. So assuming that the dividend in FY 2018 remains the same as what was distributed out in FY 2017, the dividend yield would be 4.06%. Not too shabby.

The key question then is: Is its Dividend Sustainable?

As highlighted in their FY 2017 Financial Result Presentation, the Board intends to recommend and distribute not less than 50% of the Group’s audited consolidated net profits attributable to Shareholders as dividends annually.

Fundamentally, the company is also strong financially. It has no debt and has a cash hoard of SGD 20.54 mil. See below.

Another interesting thing worth noting, is that sophisticated investors have been buying its shares since Feb 2016 to Dec 2017. See below.

So what could go wrong?

However, one figure (or shall I say trend) is worrying.

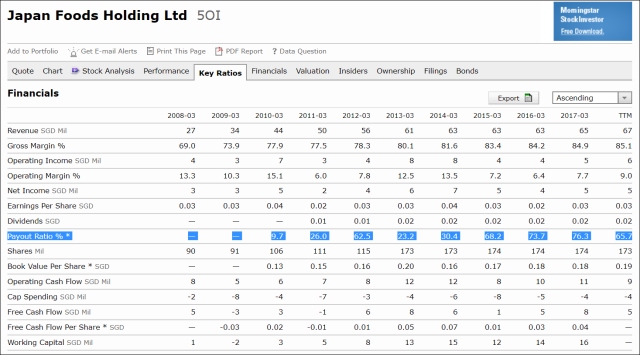

As shown in its FY 2017 Financial Results Presentation, the payout ratio has been steadily increasing over the years, but dropped in FY 2017. In FY 2016, it reached as high as 92.2%, but fortunately dropped to 74.6% in FY 2017. See below.

Interestingly, the payout ratio figures differ from what is found in Morningstar (see below).

Nevertheless, whether is it 74.6% or 76.3%, both the dividend payout ratio figures are high and the trend seems to be going upwards over the years (broken only in FY 2017).

Payout ratios have tremendous prediction power as they indicate what stage of business a company is in.

A payout ratio that is between 75% to 95% is considered very high. It implies that the company is bordering towards declaring almost all the money it makes as dividends. This increases the risk of the company cutting its dividends because our formula is forward looking. To maintain a healthy retention ratio, the company would either not grow its dividend or cut it down. (read here)

The other aspect worth noting is its erratic net profit performance. No doubt the overall CAGR for net profit is 11.1% from FY 2011 to FY 2017, however there isn’t a very strong upward trend.

With a high payout ratio (that seems to increase over time) and erratic earnings, it is difficult to predict if such dividend payout could be sustained especially if situations suddenly turn for the worse. The likely outcome is that the dividend payout will be reduced if things turn ugly. Moreover, given the fickle nature of the F&B industry.

No doubt Japan Foods can dig into its cash hoard to sustain its dividend payout in the short term, but in the long run, it is hard to say. (And why would the board want to do so? After all, the board’s commitment is to payout min. 50% of the net profit which itself could also drop in bad times.)

I am sure if you are an income / dividend investor, you would one to hold on to your dividend stock for a very long time (and let the money roll in), and not want to see the dividend get reduced or vanish suddenly.

Nevertheless, if stock price offers a good margin of safety – it would be worth considering.