These 4 Singapore stocks are small (market capitalization ranging from $300 million to about $2 billion), but if you spend some time going through their annual reports, you would be impressed by their earnings performance.

And their Return on Equity (ROE) is at least 20%.

1) STRACO CORPORATION LIMITED (S85)

Market cap: SGD 722.7M

The company develops and operates tourism-related facilities in the People’s Republic of China. The company develops and operates cable car facilities, aquatic related facilities, and dolphin and sea lion performances. It also provides management and consulting services, and project management services to third parties; and creative and artistic content, as well as is involved in the production and management of shows.

| Trailing P/E | 15.27 |

| ROE | 20.26% |

| Total cash | 167.85M |

| Total debt | 58.9M |

| Total debt/equity | 22.95 |

| Current ratio | 6.82 |

| Trailing annual dividend yield | 2.98% |

2) COLEX HOLDINGS LIMITED (567)

Market cap: SGD 59.64M

The company primarily engages in the provision of waste disposal services for domestic, commercial, and industrial waste; the sale and rental of equipment; and the repair of waste compactors. It also offers recycling, refuse disposal, and contract and general cleaning services. Colex Holdings Limited provides its waste disposal and recycling services for various clients, including commercial offices, shopping complexes, food courts, cineplexes, residential buildings, and warehouses.

| Trailing P/E | 9.38 |

| ROE | 20% |

| Total cash | 13.82M |

| Total debt | N/A |

| Total debt/equity | N/A |

| Current ratio | 3.58 |

| Trailing annual dividend yield | 1.10% |

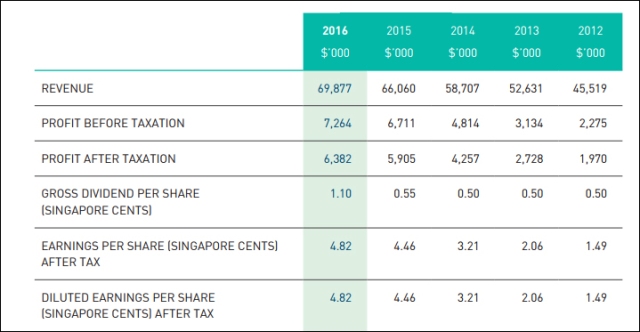

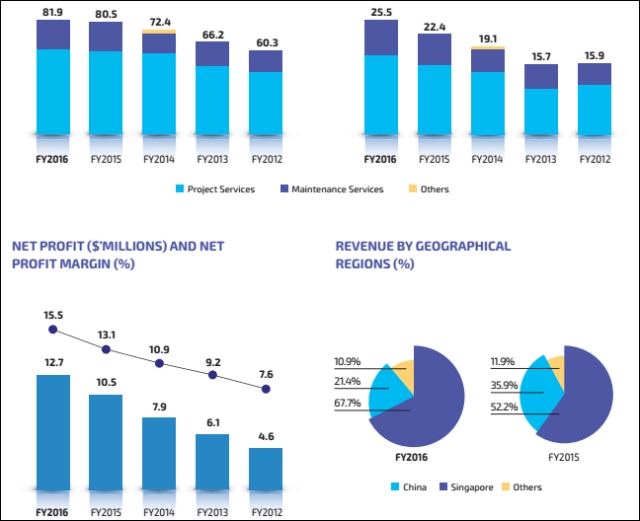

3) NORDIC GROUP LIMITED (MR7)

Market cap: SGD 165.11M

The company provides automation systems integration solutions for the marine and offshore oil and gas industries primarily in China, Korea, Singapore, and internationally. It operates through System Integration; Maintenance, Repair and Overhaul (MRO) and Trading; Precision Engineering; and Scaffolding Services segments.

| Trailing P/E | 12.73 |

| ROE | 20.14% |

| Total cash | 32.65M |

| Total debt | 26.02M |

| Total debt/equity | 37.46 |

| Current ratio | 2.11 |

| Trailing annual dividend yield | 3.10% |

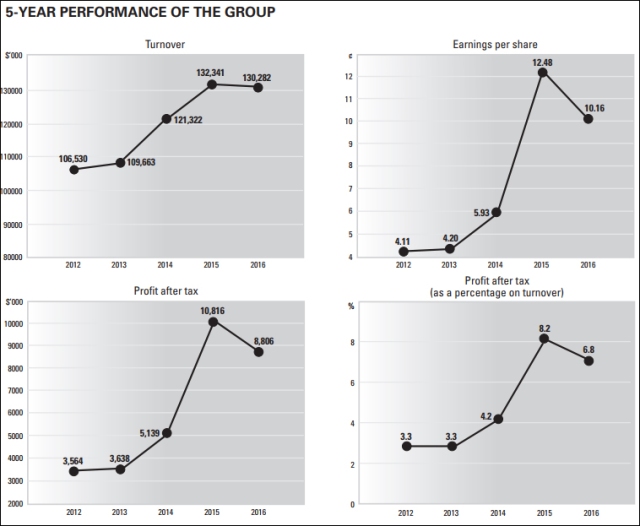

4) CEI LIMITED (AVV)

Market cap: SGD 97.97M

CEI Contract Manufacturing Limited provides contract manufacturing services to industrial equipment market in the United States, Europe, and Asia Pacific. The company provides printed circuit board and box-build assembly services, as well as equipment design, cable harness assembly, and manufacturing services; and value-added services, such as materials management, circuit layout, prototype and development engineering, metal stamping, cable harnessing, and precision machined components. It also designs and manufactures its own brand of proprietary equipment for the semiconductor industry.

| Trailing P/E | 11.08 |

| ROE | 21.96% |

| Total cash | 11.89M |

| Total debt | 2.5M |

| Total debt/equity | 6.23 |

| Current ratio | 2.13 |

| Trailing annual dividend yield | 1.24% |

A) Trailing PEG

If value is less than 1, it is good.

| Trailing P/E | Dividend Yield | EPS compound growth rate (5 yrs) | Trailing PEG | ||

| Straco | 15.27 | 2.98% | 23.1 | 0.66 |

Good (Less than 1) |

| Colex | 9.38 | 1.10% | 34.36 | 0.27 |

Good (Less than 1) |

| Nordic | 12.73 | 3.10% | 48.84 | 0.26 |

Good (Less than 1) |

| CEI | 11.08 | 1.24% | 20.14 | 0.55 |

Good (Less than 1) |

Looking at the trailing PEG values, seem like all these stocks appear to be undervalued. Nevertheless, let’s go deeper and study their intrinsic values.

B) Intrinsic Value

First, let’s look at the estimated 5 years earning growth. We are going to use a time-frame of 5 years from now for this purpose. Given EPS and a PE ratio, the stock price can easily be calculated for any company. Using the below formula.

F = P(1+R)N where:

- F = the future EPS

- P = the starting (present) EPS

- R = compound growth rate (Using the 5 yrs CAGR with EPS. However let’s take a 20% discount, as I am not really sure if growth can be maintained.)

- N = number of years in the future (5)

| P = the starting (present) EPS | R = compound growth rate (Which is 20% less than 5 yrs EPS growth rate) | N = number of years in the future (5) | F = P(1+R)N | |

| Straco | 0.05 | 18.48 | 5 | 0.12 |

| Colex | 0.04 | 27.49 | 5 | 0.13 |

| Nordic | 0.03 | 39.07 | 5 | 0.16 |

| CEI | 0.10 | 16.11 | 5 | 0.21 |

Future Stock Price

P=EPSxPE

P = future stock price

EPS = future EPS

PE = future PE

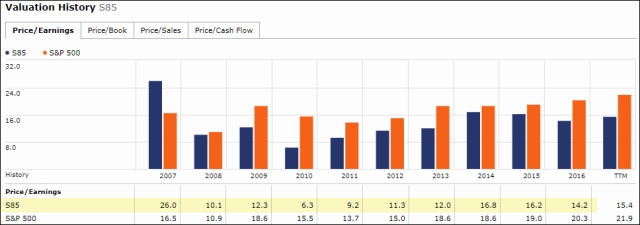

Future PE of Straco: Average of PE from 2007 to 2016 (see below) = 13.44

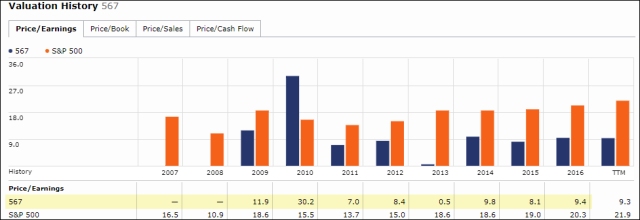

Future PE of Colex: Average of PE from 2009 to 2016 (see below) = 10.66

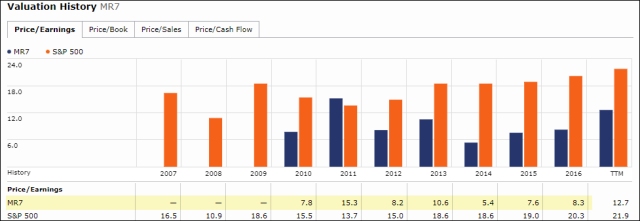

Future PE of Nordic: Average of PE from 2010 to 2016 (see below) = 9.02

Future PE of CEI Ltd: Average of PE from 2007 to 2016 (see below) = 9.79

| EPS | PE | Future Stock Price P=EPSxPE |

|

| Straco | 0.12 | 13.44 | 1.61 |

| Colex | 0.13 | 10.66 | 1.39 |

| Nordic | 0.16 | 9.02 | 1.44 |

| CEI | 0.21 | 9.79 | 2.06 |

Intrinsic Value

P=F/(1+R)N

P = present (intrinsic) value

F = future stock price

R = MARR (15% or 0.15)

N = Number of years (5)

| P = present (intrinsic) value | F = future stock price | R = MARR (15% or 0.15) | N = number of years in the future (5) | Stock Price on 4 Aug 2017 | % Margin of Safety | |

| Straco | 0.80 | 1.61 | 15 | 5 | 0.84 | N.A. |

| Colex | 0.69 | 1.39 | 15 | 5 | 0.45 | 53.3 |

| Nordic | 0.72 | 1.44 | 15 | 5 | 0.42 | 71.4 |

| CEI | 1.02 | 2.06 | 15 | 5 | 1.13 | N.A. |

In gist

Using intrinsic value and trailing PEG is one way of judging if the current stock price of the listed company is undervalued (or not). However, it is not a fool-proof way. One need to know the business of the company well (is it cyclical, does it have an economic moat etc)….

Nevertheless, it is good to keep these numbers in mind.

It does appear that Colex and Nordic stocks appear to be undervalued.

Hi,

I just came across a water treatment company named Moya Holding Asia. It’s also a boring business with a great potential. I just thought you might get interested also. What do you think?

LikeLike

Yes, it is a boring business. So is Hyflux and Sanli. Boring business is a starting point.

But its management effectiveness (eg. ROA and ROE) is poor, at -0.18% and 5.16% respectively. Nevertheless, its ROE has been getting better over the years (from -67.65 in 2009 to -12.5% in 2013 to 5.16% now). Similarly for ROA.

Its historical yearly EPS is sporadic hovering from -0.07 to 0 to -0.01 (now it is 0).

Its historical yearly Free Cash Flow is also negative. Currently at SGD -21 mil.

Its balance sheet is ok. Net cash. But current ratio at around 27 seems a bit high – show poor management or no effective use of cash.

I think fundamental wise, I would like to see better growth (ROE at least 20%), and better free cash flow (not negative). It probably won’t go bankrupt due to its cash hoard, but there are much better companies out there with better growth and good balance sheet.

LikeLike

I just published a post on Moya Holding Asia.

LikeLike