I was reading some of my old posts and came upon a post, written in May 2016 about the difference between high dividend yield vs dividend growth stocks.

That post came about because I was then reading a book about Income Investing (Income Investing with Bonds, Stocks and Money Markets by Jason Brady- click here). In the book, Jason highlighted that given the choice, he would choose the latter: consistent dividend growth.

It is easy finding US stocks with a long history of increasing dividends – they are known as Dividend Kings.

- 2017 Dividend Kings List: Dividend Stocks with 50+ Years of Rising Dividends (read here)

Not that easy in our local stock market context. In fact, to me, normally when I think of dividend stocks, my first thought is about high dividend yield stocks eg. REITs and Business Trusts.

Nevertheless, in my previous post in May 2016, I mentioned about 2 groups of Singapore Stocks. The first group (Group A) consists of local stocks which I consider as high dividend yield stocks, and the second group (Group B) consists of local stocks with consistent dividend growth.

I have two questions that I am curious to find the answers:

- Looking at these 2 groups of stocks, which of these stocks are more profitable over an extended period of time (eg. 5 years). This takes into consideration the total dividend payout (assuming we did not reinvest the payout) and the capital gain or loss due to stock price movement.

- Which stock has the highest dividend yield in relation to the original purchase stock price (from 5 years ago)?

What matters now may not matter in the future: However, before I continue, I do acknowledge that for the past years, after the 2008-2009 Great Financial Crisis, the interest rates have been held artificially low. Moving forward, we should be slowly going into a higher interest rate environment. Or to put simply, the dynamics would change.

I am not really sure how this might impact the first group of stocks which are typically REITs and Business Trusts in the next few years. They tend to more leveraged. Generally, I reckon this group of stocks will be affected more by any big spike in interest rates.

- Do Dividend Track Records Matter? (read here)

Why 5 years? The reason why I chose a 5 years period is that some of the REITs and Business Trusts which I will be highlighting later are not listed more than 5 years ago (or I can’t find their historical financial data beyond the 5 years period).

The approximate 5 year period which I have selected is from 8 June 2012 to 12 June 2017.

Nevertheless, I would much prefer a longer period of say 10 years. This, I feel should give a more conclusive verdict.

So which stocks am I talking about? This is not an easy question to answer, especially for the stocks in Group A (High dividend yield stocks).

Initially, I thought of using high dividend stocks which I am currently looking at (those that I am eyeing at, and would buy if price drop to a level I feel comfortable with). However, I felt that this method doesn’t really address the question – they are not really the highest yield.

Then how about listing those stocks with the highest yield? Again, I felt that these are not suitable (esp. when I first studied these stocks). Looking at the list of REITs from Dividend.sg (see here), I noticed that some of their high yields are not consistent eg. could be due to one-off non-recurring profits (like sale of properties, or revaluation of assets) resulting in one-off high earnings and consequently dividend payout, or it could be due to the fundamental issues with the company business itself which caused the stock price to drop precipitously resulting in a sudden jump in the dividend yield for that year (as dividend payout remain largely unchanged).

I am looking for consistency and quality yield.

Ultimately, I guess it is only fair to pit the best against the best. I have to find the best dividend yield stocks which have generated consistent good yield over a period of time, to compare with the dividend growth stocks.

In the end, these are the stocks in my list and the respective references which I took them from (See below).

Group A (High Dividend Yield stocks):

- Ascendas India Trust (SGX: CY6U) – Yield in 2016 is 4.88%;

- RHT Health Trust (SGX: RF1U) – Yields in 2016 and 2015 are 35.21% & 8.32% respectively;

- Mapletree Greater China Commercial Trust (SGX: RW0U) – Yield in 2016 is 6.74%;

- Mapletree Industrial Trust (SGX: ME8U) – Yield in 2016 is 6.15%;

- Croesus Retail Trust (SGX: S6NU) – Yield in 2016 is 6.92%.

Source: The Best Performing REITs in Singapore (read here)

According to the article above (dated 17 May 2017), the above-mentioned five constituents of the SGX S-REIT Index, have the best three-year total return (data as of 9 May 2017 unless otherwise stated).

Yes, I know, these are not very high yield stocks, but in general, as a group, these stocks have high yields and higher yields than the stocks in Group B.

Group B (Dividend Growth stocks):

- Vicom (SGX: V01) – Yield in 2016 is 4.90%;

- Raffles Medical Group Ltd (SGX: R01) – Yield in 2016 is 4.90%;

- Straco Corporation Ltd (SGX: S85) – Yield in 2016 is 2.84.

Source:

- These are the four shares with consistent dividend growth (read here)

- Rock-Solid Dividend Shares to Start 2015 With (read here)

Note: The first article is slightly dated – the original source of this article is a February 26, 2014 Motley Fools article. Of the 4 stocks mentioned in the article (CapitaMalls Asia, Super Group, Vicom & Raffles Medical Group), CapitaMalls Asia was privatized by CapitaLand in 2014, while Super Group was acquired by Jacobs Douwe Egberts (JDE) in 2017.

According to the articles, these companies:

-

- Have a track record in growing their dividend;

- Are able to grow their free cash flow and generate free cash flow in excess of dividends paid;

- Have strong balance sheets.

By the way, these stocks do not have very low yield. In fact, Vicom and Raffles Medical can be considered as relatively good yield stocks.

The Benchmark

I will be also listing the data of the STI ETF (SGX: ES3) just for reference – as a sort of benchmark for these stocks.

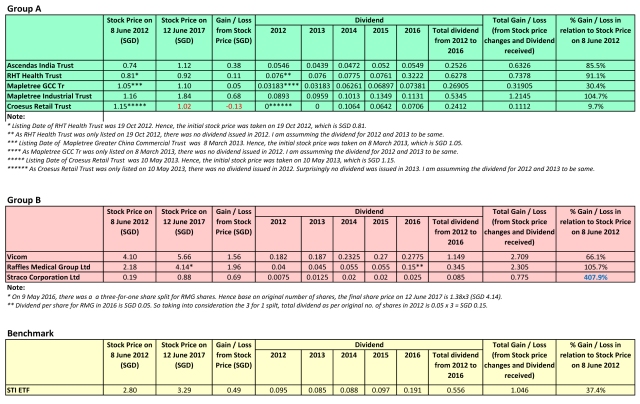

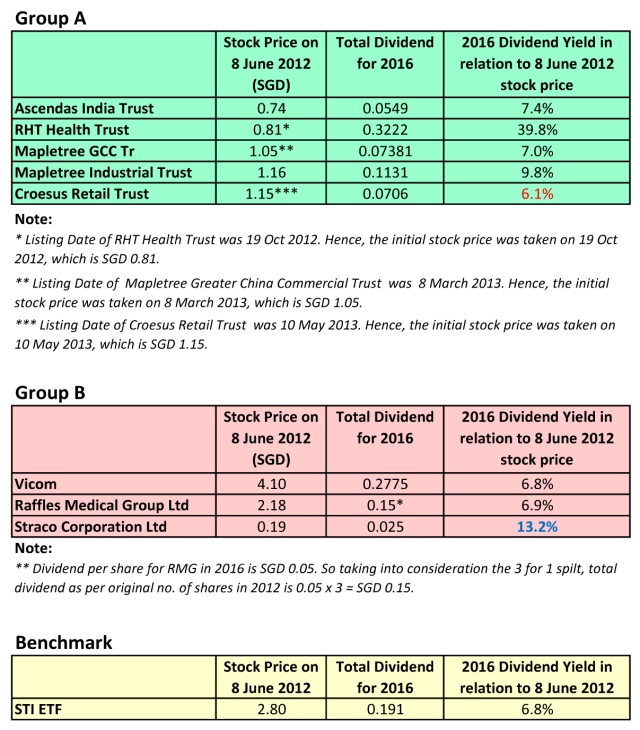

Question 1: Which of these stocks are more profitable over an extended period of time (eg. 5 years).

The profit takes into consideration the share price appreciation (or depreciation) and the total dividend received. I am assuming that the dividend received each year was not reinvested into the same stock.

For simplicity sake, I did not consider the dividend received in 2017. For a number of the REITs, as they were only listed in late 2012 or 2013, there was no dividend issued in 2013. Hence, I am making some assumptions – assuming the dividends in 2012 is the same as those received in 2013.

In very simple terms, I am assuming that the shareholder bought the stock on 8 June 2012 and held it until 12 June 2017. What is the final profit (in percentage terms) in relation to his/her original purchase price 5 years ago?

FYI, I checked out this site for the dividend figures.

Rights Issues (read here): Rights Issues have ‘impact’. I did a check on the stocks in Group A to see if there was any Rights Issue from 2012 to 2017. It appears that was none. I stand to be corrected.

The occurrence of Rights Issues will change the eventual aggregate unit share price (eg. Ex-rights value per share) and the dividend payout/DPU (whether the shareholder subscribes to it or not).

Actually, the results took me by surprise. I am surprised that Straco Corporation Ltd is the overall winner (and I am not making any assumptions for the dividend payouts in the case of Straco).

The stock price of Straco has been under pressure in recent years. In fact, 2016 was not a year of growth for the company.

One reason for the stagnant stock price could be this:

The Walt Disney Company opened Shanghai Disneyland last year; many analysts have highlighted that this attraction could potentially pull plenty of discretionary income away from Straco’s Shanghai Ocean Aquarium attraction, which is also located in Shanghai.

Here Are 4 Things To Dislike About Straco Corporation Ltd As An Investor (read here)

Another point to note, even if we include the high dividend yield over the years, Mapletree Greater China Commercial Trust did not perform well – scoring only 30.4% profit.

The results of Croesus Retail Trust (9.4%) maybe a bit unjustified due to the lack of dividend payout in 2013, and my assumption for dividend payout in 2012. Do note that certain assumptions were made for the dividend payouts and initial stock prices for a number of the REITs as they were only listed in late 2012 and in 2013.

The lowest 2 scoring stocks are found in Group A (Croesus Retail Trust & Mapletree Greater China Commercial Trust). The 3rd lowest scoring stock is Vicom (Group B).

The top 2 scoring stocks are found in Group B (Straco and Raffles Medical). While the 3rd highest scoring stock is Mapletree Industrial Trust (Group A). By the way, their returns over a 5 year period is way more than those of the STI ETF.

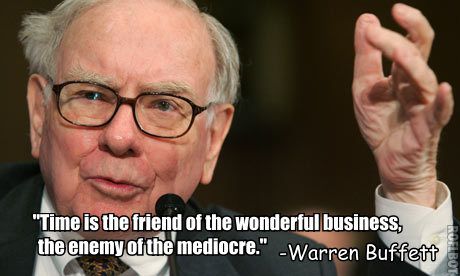

Question 2: Which stock has the highest dividend yield in relation to the original purchase stock price (from 5 years ago)?

Again, I am considering the total dividend received in FY 2016 as the final total dividend for consideration here. We do not have the FY 2017 dividend amount since we are only halfway through 2017.

Time is an important factor when it comes to good growing stock (with increasing dividend payout). Theoretically, the eventual yield of a good stock should be higher (and compound) in relation to the original yield.

From the figures above, it may seem that RHT Health Trust is the winner. However, its dividend payout in 2016 is abnormally high compared to the other years.

This is due to the Special distribution of S$0.248 in 2016, and it is non-recurring. In 2016, RHT signed a MOU to dispose 51% of its economic interest in FHTL to Fortis Healthcare (FHL) for S$300m (INR14.3bn). The disposal of the FHTL stake also resulted in RHT Health Trust declaring a special distribution of 24.8 cents per unit. (read here)

If we exclude this special distribution, the dividend payout for 2016 will be only SGD 0.0742, resulting in the ‘2016 Dividend Yield in relation to 8 June 2012 stock price’ to be only 9.2%.

So the winner here again is Straco (Group B), followed by Mapletree Industrial Trust (Group A) and RHT Health Trust (Group A) at 9.2%, respectively.

In general, for most of the stocks listed here (except for Croesus Retail Trust which has the worst eventual yield), their eventual dividend yield relative to the original purchase price of the stock is higher than the eventual yield of the STI ETF.

In summary

They say time will tell if the stock you bought is good or bad. Although we can’t foresee the future, studying the past helps us in forming our judgment moving forward.

Yes, we must always bear in mind that the dynamics in the future might change (eg. Interest rates rise, business fundamentals, new competitors, etc). Investing in stocks is never truly passive.

Nevertheless, this study is only limited to a few stocks and may not be representative of all the stocks in the Singapore market. Moreover, certain assumptions were made for the dividend payouts and initial stock prices for a number of the REITs as they only listed in late 2012 and in 2013.

I am surprised that Straco Corporation Ltd came out top in both studies (Question 1 and 2). The winner this time seems to be Group B (Dividend Growth stocks). However, only time will tell which stock will be the eventual winner.

Shall leave with this song. Something to perk you up.

Hi there,

I am also covering Raffles Medical and Straco Corp in my investment blog, SG Wealth Builder.

As for REIT, I am monitoring Suntec Reit.

Anyway, thanks for the informative article. Like your analysis.

Regards,

Gerald

http://www.sgwealthbuilder.com

LikeLike

Glad you like the post. Thanks.

BTW I did read your blog posts. They are a good read.

LikeLike