I have been reading posts by fellow financial bloggers and articles online pertaining to investing. Every so often I would come across the term investing in dividend stocks.

I don’t consider myself good at evaluating dividend stocks. Nevertheless, I hope to use this post to sort out my thought process. Feel free to correct me on any mistakes you see.

How to evaluate dividend stocks

My general view is that these are typically mature companies’ stocks, which typically choose to distribute portions of their free cash flow to investors in the form of dividends rather than invest for growth (given the lack of possible further expansion).

There are many ways to evaluate these ‘dividend stocks’. Yes, it is important to study the business of the company and make an intelligent forecast of the future prospect of the company. However, there is always a limitation in accurately predicting how policies may change and if a new competitor would emerge (as highlighted by Budget Babe in her post on Starhub – read here).

On the other hand, we can look backward (in history) into the past performance of these companies and estimate if these companies can continue paying such high dividends moving forward in normal times (without any crisis) or in times of crisis (eg. sudden rise in interest rates). After all, the history is the only fact we can actually lay hands on.

Since, like I said earlier, to me these are typically mature companies (not high growth small companies), to value these companies’ intrinsic value via EPS growth or DCF models would not be appropriate. In addition, these companies also would fail as high growth stocks if you look at them from the point of view of a GARP investor (ROE typically less than 25%).

There are numerous ways to skin a cat. I am aware that there are many seasoned dividend investors in the local blogosphere. And each of them has their own ways of evaluating dividend stocks. Ultimately for each of us, we need to find our own individual way (in evaluating a dividend stock) which is best suited for ourselves. The worst is to just blindly follow what others are buying (or selling) – and worse – blame others when things fall apart. After all, we are our own worst enemy (in investing).

A few ways which I think offer us investors confidence in purchasing the dividend stock (and holding onto it) are:

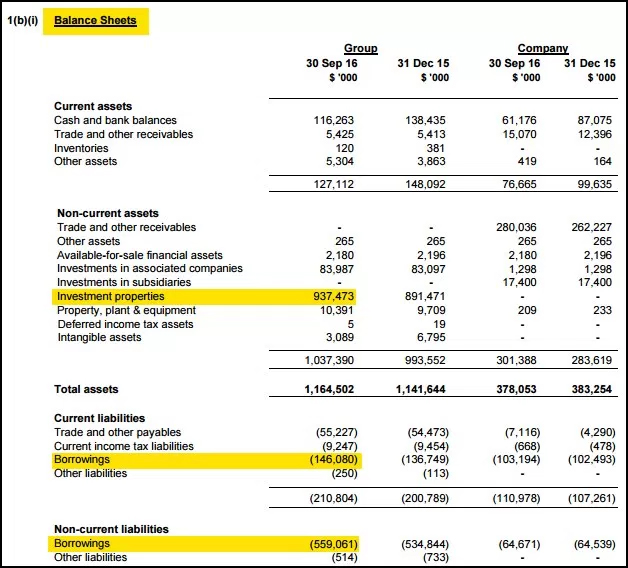

1) Studying the Balance Sheet of the company.

AK’s recent post on his purchase of Centurion Corporation Limited shares is a good example (AK, I hope you don’t mind me using your post here :p). He mentioned that Centurion had about $700 million worth of debt (eg. add $146 mil of current borrowing with $559 mil of non-current borrowing), and investment properties worth $940 mil. See below table.

He thought about what would happen in the event of 1% increase in interest rate (eg. would the reduced EPS be sufficient to cover the dividend payout, etc). It is kind of like a ‘stress test” so to speak.

Ultimately the primary interest of the company will be to ensure that there is sufficient liquidity to continue to operate (Not to pay out as much dividend to shareholders).

However, having said that, a reduction in dividend payout will inevitably cause a drop in the company share prices, and if share prices drop too low, there will be a risk of takeover by external parties.

“Cash, though, is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.” Warren Buffett

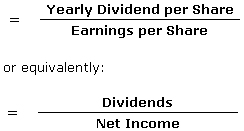

2) Dividend Payout Ratio and Free Cash Flow

Another common way is to study the historical trend of the dividend payout ratio (read here).

Dividend Payout Ratio as calculated as:

A good indicator of whether falling earnings pose a risk to dividend payments is the dividend payout ratio, which simply measures how much of a company’s earnings are paid to shareholders in the form of dividends. If the trend of the dividend payout ratio is upwards over the years (despite a constant dividend payout) – it would typically mean that the earnings and net income are declining, and over time, it will reach a point when earnings would be insufficient to cover the dividend payout. Yeah, you can literally see the ‘train’ coming towards you.

Dividends are paid from a company’s cash flow. Free cash flow (FCF) tells investors the actual amount of cash a company has left from its operations to pay for the dividends. Budget Babe in her post on Starhub (read here), highlighted that Starhub’s dividend payouts have outstripped its free cash flow for the past few years, so that was a sign that the company was struggling to keep up its dividend payments (even without the 4th Telco coming in).

3) Applying bond valuation to REITs

In this article, the author mentioned that assuming REITs are like bonds, and knowing what the spreads are in comparing the REIT’s yield to the 10-year government bond.

Different factors affect the share prices of REITs:

- Spreads between REIT yield,

- Bond yield,

- DPU,

- Bond yield rate.

Spreads get higher in times of crisis (people are factoring slower growth rates for REITs), and with higher 10-year government bond yield (given the rising interest rates), plus lower DPU – all these will cause the share prices of REITs to drop.

My thoughts on Real Estate Investment Trusts (REITs)

REITs are a favorite among many dividend income investors. Ever since the end of the Great Financial Crisis, given the low-interest rate environment, REITs have offered many investors a great way to earn high passive income. In fact for some investors, their portfolio consists mainly (or only) of REITs.

Ok, personally, I do view stocks with very high dividend yield with a fair amount of suspicion (eg. too good to be true). And in fact, the higher the yield, the more I would study it. Frankly, given the choice, I would go for a fundamentally strong company with a moderate yield (3 to 4%) vs a company with high leverage (weaker fundamentals) but high dividend yield. And this principle, by default, would make me strike off a lot of REITs from my radar. They are after all highly leveraged instruments.

On another note, REITs are required to distribute at least 90% of taxable income each year to enjoy tax-exempt status by IRAS (subject to certain conditions). Hence, as a whole, it would be unfair to dismiss REITs due to their high payout ratio.

While I look with envy at how much dividend others have collected from their REITs investments (some receive payouts almost every month), there is a certain reluctance within me to purchase any of them yet.

A lot has been said about what REITs can do for a normal retail investor. But let’s think first – why do developers want to create REITs in the first place. Being in the construction industry, I would inevitably meet people working for developer companies. And in many cases, in very simplistic terms, to the developers, REITs is an economical way to raise the much-needed cash (via an IPO of the REITs) while at the same time allow the Developer to retain ‘control’ of their assets via the REIT’s manager.

I am sure being beneficial for retail investors would not be at the top of the developers’ lists when they created the REITs.

Prior to the creation of REITs, developers often would have their cash tied down to their heavily leverage property assets, which would prevent them from further investing in future developments. A property is, after all, a very expensive item – most developers would need to borrow heavily from banks to purchase the land, construct, market it, sell or rent, etc… there is only so much they can borrow from the banks.

REITs can help both developers and investors, says Cushman and Wakefield’s Sanjay Verma (read here)

To quote from the article above:

“For developers, it is an avenue to raise capital. Today, a developer can go for an IPO but it is not advisable based on the legacy of some of the IPOs. He can raise debt at high rates because the balance sheet is not healthy. He can go for private equity but that is also expensive. REITs will probably be the most economical capital.”

It appears to be a win-win situation for both the developer and the retail investor (at least from the period after the Great Financial Crisis till now).

However, before I continue further: There are ‘sponsored REITs’ and ‘non-sponsored’ REITs. Well, so far I have been talking about ‘sponsored REITs’ eg. those REITs spun off from developers. Nevertheless, the link between the seller and buyer (eg. REIT manager) of the property isn’t always clear to us retail investors. That’s probably a topic for another post.

Why my reluctance to invest in REITs yet…

Ok, besides the fact that markets have been reaching new highs…

Now, there are 2 cases which I have read recently, which made me think hard about what might cause this relationship between the developer / REITs & retail investor to sour.

Case 1: The case with Lippo Malls Indonesia Retail Trust (LMRT)

I am sure most would be aware of Lippo Malls Indonesia Retail Trust and its high yield.

Lippo Malls Indonesia Retail Trust Has A Yield Of 9%: 3 Things Investors Should Know (read here)

There are many things to like about Lippo Malls Indonesia Retail Trust (yes, there are many reports on its rising DPU). To be fair (before I go further), the last time I checked, Lippo’s gearing is not at the super high level (eg. at 35%) – read here.

However, there are some questions which I personally felt unanswered.

In this Nov 2016 report by OCBC, there was a mention of a debt fuel growth (emphasis mine): “As a REIT that pays out most of its earnings through dividends, we estimate that most of the revenue growth that LMRT has seen over the years was due to acquisitions, as gains from rental reversions were eroded by currency losses. Since 2011, LMRT has undertaken SGD1.16bn of acquisitions, boosting total assets to SGD2.13bn as of 3QFY16. The acquisitions were funded with a larger portion of debt, as LMRT only raised SGD467.6mn in equity and SGD140mn in perpetual since 2011.”

In another report by Moody’s dated 26 Feb 2016 (read here), it mentioned that (emphasis mine): “the trust has no further headroom for additional debt-funded transactions, although the credit impact of two new announced acquisitions will depend on how they are funded.”

So in very simple terms, here is a REIT which has been embarking on a debt fuel growth and has not too long ago reached the point whereby it cannot further fund the acquisitions via debt. So how does, the manager continue the revenue growth when most of its income is paid out via dividend?

Perpetual debt the new equity for landlords in Singapore (read here)

Can REITs use perpetual bonds to outsmart leverage rules? (read here)

Perpetual Bonds: Equity in Disguise (read here)

The Monetary Authority of Singapore capped borrowings of REITs at 45 percent of assets from 2016 and debt that can be considered equity offers landlords a way of complying with the stricter rules. With the lower leverage threshold, there might be more Singapore REITs who will look to tap this source of funding given it is still treated as equity instead of debt

Under global accounting rules, bonds with no fixed maturity that allow the deferral of coupon payments may be treated as equity. A perpetual bond – sometimes referred to as a “perpetual” or “perp” – is a bond that has no maturity date. The agreed-upon period over which interest will be paid is forever. Because of this unique characteristic, perpetuals are commonly treated as equity rather than as debt, even though they’re really debt instruments.

Ah yes, the use of Perpetual Bonds. Investment Moat did a great post about Perpetual Bonds all the way back in March 2012.

In other words, Perpetual bonds blur the boundary between debt and equity. They provide capital without having to raise equity. (read here)

They are also technically not termed as debt on the balance sheet.

In this article, it states that (emphasis mine): ” Subject to certain requirements, a perpetual bond issue will be treated as equity on the company’s balance sheet, which will not have an impact on its reported debt levels (which has implications for the REIT�s gearing ratio).”

Frankly, if you ask me, debt is debt (whether you call it Perpetual Bond or otherwise). Perpetuals are classified as fixed-income securities, coupon payments are mandatory (although they do allow for deferral of coupon payments). One key difference is that borrowings are something we as the retail investors can see on the balance sheet, while Perpetual Bonds are not reported as debts or borrowings.

So if I am to use the balance sheet as mentioned above to evaluate the risk of the REIT, perpetual bonds (as borrowings) would not be included (not be detected at all). By the way, AK is well aware of Perpetual Bonds (read here).

And also, people seldom use Free Cash Flow to evaluate REITs (eg. as per Budget Babe’s post above about Starhub). After all, we know that 90% of the net income are paid out as dividends. They typically use funds from operations (FFO) and adjusted funds from operations (AFFO) (read here).

Paying more for something less

Now let’s go back to LMRT, using this article again. It states(emphasis mine): “Since 2011, LMRT has undertaken SGD1.16bn of acquisitions, boosting total assets to SGD2.13bn as of 3QFY16. The acquisitions were funded with a larger portion of the debt, as LMRT only raised SGD467.6mn in equity and SGD140mn in perpetuals since 2011.”

For a REIT, gearing ratio is the total borrowings (both short-term and long-term) divided by total assets.

Now let’s look at LMRT’s Gearing Ratio over the years (see below):

- As Reported in its 2011 Annual Report: Gearing Ratio is 8.7% (Gearing remained conservative as at 31 December 2011)

- As Reported in its 2012 Annual Report: Gearing Ratio is 24.5% (Gearing remained moderate as at 31 December 2012 )

- As Reported in its 2013 Annual Report: Gearing Ratio is 34.3% (Gearing as at 31 December 2013)

- As Reported in its 2014 Annual Report: Gearing Ratio is 31.2% (Gearing remained conservative as at 31 December 2014)

- As Reported in its 2015 Annual Report: Gearing Ratio is 35.0% (Gearing remained conservative as at 31 December 2015)

And the Net Asset Value vs Purchase price of their Property Portfolio in 2011 and 2015 respectively (see below):

- Net Asset value as reported in 2011 Annual Report is S$1.545 billion, while purchase price was S$1.3135 billion.

- Net Asset value as reported in 2015 Annual Report is S$1.83 billion, while purchase price was S$2.0877 billion.

Working backward (in very simple mathematics, excluding all other misc. costs), let’s calculate the total borrowings in 2011 and 2015:

- In 2011, the Gearing Ratio was 8.7% while NAV was S$1.545 billion. So total borrowings would be S$0.134415 billion (Total Borrowing / Total Asset Value x 100 = Gearing Ratio).

- In 2015, the Gearing Ratio was 35% while NAV was S$1.83 billion. So total borrowings would be S$0.6405 billion.

So in other words, between 2011 to 2015, LMRT borrowed an additional of S$0.506 billion (0.6405-0.134415) to increase NAV by only S$0.285 (1.83-1.545). I do not understand why any company would borrow more to acquire assets that are valued less.

To further highlight this point, in its 2015 Annual Report, the purchase price of its asset is much more than their NAV. (S$2.0877 billion vs S$1.83 billion)

Also, on a minor note, why would they term a gearing ratio of 24.5% (in 2012 AR) as moderate while a gearing ratio of 31.2% (in 2014 AR) as “conservative”?

There is a reason why MAS adopts a unified gearing cap of 45% recently (read here) “the effect of rising interest rates on gearing. Property asset values are calculated based on the total income derived from the rental of said properties, which means that rising interest rate and total debt costs will affect gearing ratios by lowering the asset value if rental yield increases do not keep pace with the increase in interest costs. This will lead to the gearing ratio increasing for the REIT, even if there is no increase in net borrowings.“

In fact, at current low-interest rate environment, a gearing ratio of 35% is already high. Even if they (LMRT) do not borrow more, a higher increase rate in the future would indirectly increase this ratio.

However, let’s hold on to these thoughts here first….

Nevertheless, LMRT keeps on ‘borrowing’ via Perpetual Bonds. In Sept 2016, LMRT issued SGD140 million in 7% perpetual bonds.

Lippo Malls Indonesia Retail Trust sells perpetual bonds offering at 7% (read here)

Lippo Malls REIT issues SGD140 million in 7% perpetual bonds (read here)

Distribution payments at a rate of 7% per annum for the qualified investors are very tantalizing. However, I do wonder why a company would want to issue bonds at such a high rate? For what benefits to the company? And to add to the puzzle, portion of the proceeds (from the issuance of the 7% perpetual bonds) is used to redeem its maturing S$150m bond at 4.25% distribution rate (read here). Why borrow at a higher rate only to pay off a debt which is at a lower rate? What’s more, in recent times, more and more of these debts are in the form of Perpetual Bonds which are ‘invisible’ to most retail investors reading the balance sheet.

I can think of a few reasons:

- For Perpetual Bonds, because there are no maturity dates, the interest required to compensate the bond holder will typically be higher. So technically, LMRT is paying more interest for the sake of a long or indefinite duration debt.

- Perhaps, it might be, still be a good time to take advantage of the low-interest environment to issue a long or indefinite duration debt.

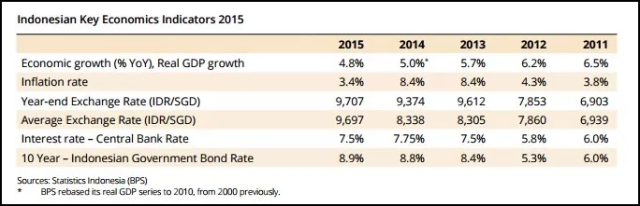

- In comparison to other sources, this 7% is considered reasonable or low. As highlighted in LMRT 2015 Annual Report (AR), the Interest rate – Central Bank Rate (Indonesian) in 2015 is 7.5% while the 10 Year – Indonesian Government Bond Rate is 8.9% (and both rates seem to be increasing over the years). See table below.

- If LMRT can borrow at a high rate to acquire assets generating income at an even higher rate, it might not seem that bad. In general, the property yield of LMRT is 8.75% (read here) which is higher than 7%. NPI, as shown in LMRT 2015 AR for FY 2016, is S$171.86 mil, while asset size is S$1.9 billion (however, I think we should be using purchase price – which I read in AR 2015 is S$2.0877 mil). Yield estimated at approx. 8.23% – seems about there.(read here)

- However, let’s look deeper, at the assets LMRT recently purchased:

- Dec 2016: LMRT acquired Lippo Mall Kuta at a price of S$59.8 million. Based on the pro forma financial statements for the financial year ended December 31 2014, the net property income (NPI) contribution from LM Kuta would be S$7.3 million. So assuming NPI won’t change much after purchase, the yield is approx. 12%. (read here)

- July 2015: LMRT acquired Lippo Plaza Batu (LPB) and Palembang Icon (PICON) for a total consideration of S$106.8m. Given its estimated NPI yield of c.8.0% (read here).

So 7% interest for borrowing in perpetuity might not seem that bad. Actually, I do wonder why would someone invest in Perpetual Bonds (Perps) of LMRT at 7% when they can get a higher rate by investing in LMRT stocks (yield 7.95%)? Perps have no potential for income growth and high-interest rates can wreck havoc on their values. REITs, on the other hand, have the ability to increase income in line with inflation, and also offer the potential for capital appreciation. Well… I think things may not be that simple…

However, having said that, there are still risks and questions:

- LMRT is subject to Forex risks. In simple terms, LMRT borrows in SGD to buy Indonesian properties which produce income in Indonesian Rupiah which LMRT need to convert back to SGD annually to pay back the debt holders. So if SGD rise against the Rupiah, it may erode the gain in profits in Rupiah. There appears to be a drop in the value of SGD against the Rupiah in 2016.. but from a macro long view of 5 or even 10 years, the trend is up. Then again, I am not good at predicting trends.

- What is announced in the news about possible NPI yield prior to the acquisition of the asset by LMRT may be inflated? And the NPI drop after the purchase (probably due to the expiry of short term leases engineered prior to the purchased). Let’s look at one property that LMRT purchased in Dec 2014: Lippo Mall Kemang. The purchase price was S$362 mil. NPI for YR 2015 is S$27.8 mil (as shown in 2015 AR). So NPI yield is approx. 7.7%. Nevertheless, in this report dated Sept 2014, it stated that based on the pro forma financial statements for fiscal year ended 31 December 2013, the Net Property Income contribution from Lippo Mall Kemang was $33.6 million. (From 33.6 drop to 27.8 mil).

- Issuers are often forced to pay a “penalty” for not calling back a perpetual bond issue (read here). This penalty usually takes the form of a higher rate of interest to be paid to the bondholder, in the event that the bond is not called by some pre-determined date. Also common is the resetting of the coupon rate to another based on a combination of prevailing interest rates (at some time in the future) plus a predetermined spread. In the case of LMRT 7% Perpetual Bond (read here), there are reset dates. Reset distribution rate will be the prevailing five-year SGD interbank offer (SIBOR) rate in addition to an initial spread of 5.245%. So, in gist, the 7% might not stay that ‘low’ forever.

- Most of the demands for SGD perpetual bonds have been from retail investors. However Perpetual bonds are typically bought by institutions and high net worth individuals. If these bonds flow heavily to the retail investors, the results (for the investors) may be bad – I am not sure if most of the retail investors are aware of the risks involved in a rising interest rate environment, and do they have the long term holding power & mentality. For a 10-yr bond, a 1% rise in interest rate will cause it to drop 10% in price. For perpetual bonds with no maturity, the drop can easily be more than that. I really don’t know how the Perpetual bond market situation will pan out when rates increase significantly (and frankly I don’t think it looks pretty). In 2015 alone, Singapore REITs issued a record S$700 mil worth of perpetual notes with no maturity dates. In this article (read here) dated Aug 2016, the 6% Perpetual Bond sold by Hyflux to mom-and-pop investors have declined to 95.4 cents from about 100 cents as recently as Aug 12. Yeah, in the short term, it may be good for the companies issuing the perpetual bonds, but when these bonds get a really bad name by the public, the house of cards may fall. Fewer buyers – higher rates – spread wider.

In gist, Forex fluctuations and NPI values are not constant. While the purchase price is more or less constant. In a difficult environment, with lower occupancy rates (which equates to lower rent income), NPI will drop.

Perpetual Bond rates are significantly higher than bonds with maturity dates… For the REIT, a sudden rise in the amount of Perpetual Bond issuance in too short of time would not be good for it. LMRT average property yield and its recent acquired assets NPI yield are pretty close to 7%… and I doubt future issuance of Perpetual bonds by LMRT will be at a lower rate (than 7%) and will property yield increase in the future? And like I said, if LMRT ensures that its assets generate better yield than the perpetual bonds, things would be fine. Fail to do that, in a rising rate environment, and with a unified gearing cap of 45% by MAS, the balance will tilt to LMRT’s disadvantage. A fine balancing act.

And who is Lippo Malls Indonesia Retail Trust buying these assets from? If I am not wrong – it should be from PT Lippo Karawaci Tbk. PT Lippo Karawaci Tbk. (“LK”) is LMRT’s sponsor. LK is Indonesia’s largest listed developer by total assets and revenue.

LMIRT announcement on 8 January 2016 that it had entered into an agreement with its sponsor, PT Lippo Karawaci Tbk (Ba3 stable), to acquire Lippo Mall Kuta for IDR900 billion (SGD82 million).

Case 2: The case with Sabana Shariah Compliant REIT

I am sure people would have by now know about the saga between the REITs manager and a group of unitholders: “Besides a removal of its manager, unitholders are also calling on the Singapore-listed industrial REIT to rescind its three most recently announced acquisitions.”

Investors reiterate calls to remove Sabana REIT’s manager despite assurances of review (read here)

As stated by Lepak Investor in this post (emphasis mine) “having a REIT with a sponsor is a double-edged sword; particularly if the REIT made some purchases which are of a questionable nature in terms of valuation and yield accretion…………… In essence, this deal seems to heavily favor two parties – the sponsor (including the REIT manager), and new investors…”

I would like to focus on this issue about the overvaluation of the Changi South property.

Disgruntled Sabana REIT unitholder lodges complaint with CAD overvaluation of Changi South property (read here)

Sabana Reit says book value of property to be acquired not relevant for current deal (read here)

I admit that I know very little about the valuation of properties.

“The worst thing you can do is invest in companies you know nothing about. Unfortunately, buying stocks on ignorance is still a popular American pastime.” Peter Lynch

Nevertheless, reading this article (read here) from NRA Capital, it states that “Property asset values are calculated based on the total income derived from the rental of said properties…” That sounds fair. An asset is, after all, something that puts money in your pocket; rents are income.

The use of NAV (Net Asset Value) is a favorite among investors in evaluating the value of REITs. This I reckon is often obtained from property valuation houses in Singapore. However, in the case of Sabana’s Changi South Property, unitholders are questioning the valuation reports by the property valuation houses of Colliers, Savills and Knight Frank.

There are a number of points worth noting in the issues raised by the unitholders:

- Valuation houses are engaged by the seller and the buyer (in this case Vibrant and Sabana REIT’s manager). There would be an issue with a conflict of interest, after all, these valuation houses are engaged by the seller & buyer respectively.Would anyone bite the hand that feeds them (in a small market like Sg)?

- All three valuation houses concluded that the property was worth exactly $23 million, which is also the price at which Vibrant will sell the asset to Sabana REIT. The property was acquired by Vibrant Group in Mar 2011 for S$10.9 million. Sabana Real Estate Investment Management said that Vibrant Group had purchased the property for its own use, and hence the S$10.9 million book value represents the original cost of acquisition without accumulated depreciation. I still don’t understand the statement: You mean a property is valued less because it is for the company’s own use, while it is more expensive when it is not? I am sure if Vibrant rent out the building, it would get about the same rent as if it is under the REIT’s management.

Would this be a case of money coming in from one hand and going out from the other? The REIT’s sponsor selling at a higher price / questionable valuations to the REIT’s investor (who as passive investors have very little say in the decision). Profits end up in the (REIT’s sponsor) developer’s pockets.

On paper, the NAV appears favorable, but who are we to question these valuations? Also, why would we – unless DPU dropped (resulting in share prices dropping as well).

And what are the chances of a unit holder lodging a complaint to the white-collar crime department of the Singapore Police against the property valuation houses?

If I do not know, then I think it is wise that I do not invest.

In Summary

Like I said earlier, I felt that some of these questions remained unanswered (at least for me).

From the start, I mentioned it is not easy to evaluate dividend income stocks. Often we read about the increase in NAV and DPUs for REITs in the news, but one must always focus on how sustainable the dividend payout (or even earnings) is in the long term.

Although the use of balance sheets, dividend payout ratios and free cash flow is useful. These by themselves are not perfect.

The use of Perpetual Bonds often listed as Equity under the balance sheet is often not obvious to us retail investors. The rise in DPU may sometimes mask the fact that the borrowings are increasing at a higher rate than the actual asset value of the properties purchase. When interest rates rise, REITs may be hit by both the increase in interest payments pertaining to its debts and also the mandatory coupon payment to the bond holders.

And one should question if such purchases (assets acquisitions) are beneficial to the retail investors/unit holders or the REIT’s manager / REIT’s sponsors.

All is rosy when both parties (investors and REIT’s manager & sponsor) benefit. But as we can see in the case of Sabana- it ain’t pretty when things come crashing down.

“No one can see a bubble, that’s what makes it a bubble.” (click here).

Nevertheless, I am never against REITs, and in fact, am always on the lookout to invest in REITs or other high dividend yield stocks (for passive income) with strong fundamentals at the right price. And yes, need to study more into the different REITs and these stocks more…

Wow! Very detail and great analysis about how perp bond may affect the REIT ! And some hidden issues behind this ….

Cheers! 👍👍

LikeLike

Thank you. 🙂

LikeLike

Great job.

I attended the Asia Ex Japan REIT ETF presentation.

I raised this concern about the future of REITs that it is big space occupiers of hoteliers, industrialist and offices having to contend with disruptive economies. Even if it affects only some sectors, it is good enough to roll back our investments.

The CEO did not give a satisfactory response.

What’s your thoughts?

LikeLike

I can’t really comment on REITs beyond Singapore’s shore. But pertaining to REITs having all or most of their properties in Singapore: For Industrial & Commercial – I know for sure, in the near future there is a huge influx of new areas / properties. So rent will be under pressure.

I do like Heathcare REITs like First REITs and Parkway Life (there lease renewal is also longer). With an aging population – seems like a sunrise industry to me.

As for the disruptive economics – well, there are 2 ways to look at it. Guess your question in relation to the REIT ETF is too broad for the CEO to reply. The traditional REITs may suffer but there are also ways in which REITs can capitalise on e-commerce (Keppel DC REIT, EC World REIT – ecommerce need space for data storage, supply chain and logistics). However, having said that, I still think Singapore has an oversupply of retail, industrial space & offices- so it is a tenant’s world now here. I can’t see a solution as of now. The next few years would be interesting. And I am not sure of the situation overseas, neither do I know when interest rates will rise… might take longer than we know.

I am not totally against REITs , but sometimes, the dividend received may not be able to cover the capital loss (in share price). And I am really those very hands off kind of investor. So if I really want to invest (for the yield), I had to wait for the perfect storm (market crash) for a wide margin of safety (and even then I prob just go for healthcare REITs or relatively low leveraged REITs) . Unfortunately, now is not the time- so why rush? There are actually other stocks with better balance book (less debt) and ok dividend yield.

LikeLike

Awesome stuff!

Totally agree with your POV. With the combined impact of:

1) Increasing interest rate environment with US raising rates and ID which just announced that they will no longer cut rates (http://www.thestar.com.my/business/business-news/2017/02/06/indonesia-adopts-cautious-stance-on-us-new-trade-policy/)

2) Decreasing demand due to excess supply of commercial / industrial properties

These factors will definitely put pressure on FCF / DPU.

On your 3 points on valuation, I have always wondered how to determine a “safe” valuation estimate / margin of safety for REITs.

1) BS or book value is not useful as properties are marked to market yearly and will fluctuate with the property market.

2) Using the dividend ratio as you mentioned is a mere indication of ability to sustain payouts. It does not justify if we are under/over paying for REITs.

3) Applying bond valuation sounds interesting, but as rightly pointed out in the article, this method treats REITs as simplified bond issuances which in reality they are not. The article also goes on to point out macro ways of understanding prices.

Perhaps a top-down approach (ie macro view such as demand / supply conditions and interest rate environments) might better justify the value?

After all we are buying into rental yields of properties and as the saying goes for buying properties “timing is critical!”

LikeLike

Thank you. It is always good to think through before pressing the buy button.

LikeLike