Ok, the earning reporting session just passed.

I have previously done the updates for the earnings for my stock portfolio for the previous quarter. You can read it here.

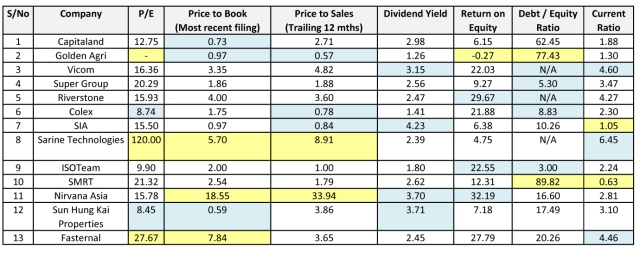

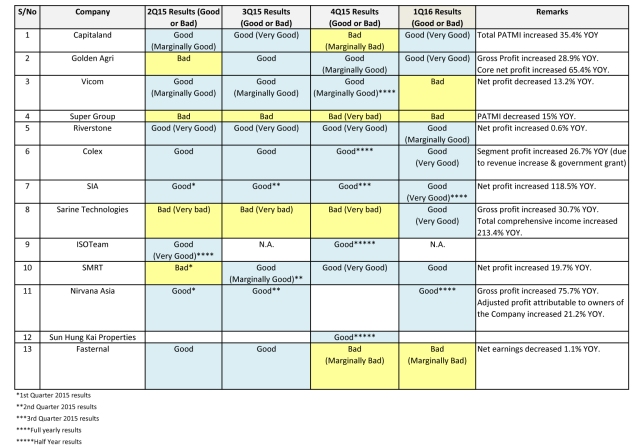

Let’s do a quick update on the recent earnings performance of the stocks in my portfolio (see below).

1) The earnings of Vicom for this quarter has turned south. While in the case of Sarine Technologies it has turned positive dramatically. This quarter earnings of Riverstone has paled in comparison to its previous quarters (growth has slowed).

2) Financial metrics wise, the price to book of Golden Agri has increased a lot from 0.46 to 0.97, while its debt/equity ratio has increased from 34.81% to 77.43%. Seems like the stock price has risen considerably (due to better earnings over the past quarters) while balance sheet has not. Sarine Technologies P/E remains very high at 120 (although earnings have improved).

In gist, most of the stocks in my portfolio has a good quarter. Yeah!

U holding on to Vicom?

What do you think it will go from here?

LikeLike

I think in the next 2 to 3 years the no. of older vehicles will decrease and will affect Vicom vehicle inspection portion (check out one of my older post – http://www.apenquotes.com/?p=570).

For its Setsco portion, the slowing economy has an impact on it as well (for one the construction industry and oil and gas slowed). But as a testing agency, Setsco is well respected here…

Overall, the business moat of Vicom as a company is still intact. It is still the big fish in a small pond. In 3 to 4 years time it should improve.

The other issue is electric vehicles– as of now electric vehicles need to be tested so Vicom ‘s role is still vital should the vehicle industry transform with Tesla at the forefront.

Of course it would be vital for Vicom to expand overseas esp. with Setsco while keeping their major share in Sg.

LikeLike

Pingback: Investing and Vexation 101

Pingback: Investing and Vexation 101 | A Pen Quotes