Ok, every now and then I would look at the financial statistics of the companies which I have invested in.

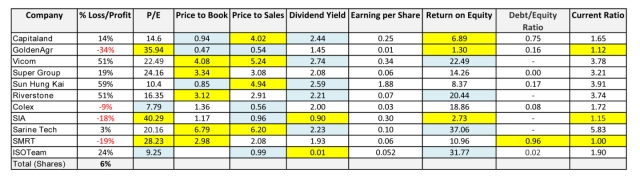

On 3 May 2015, I created the table below.

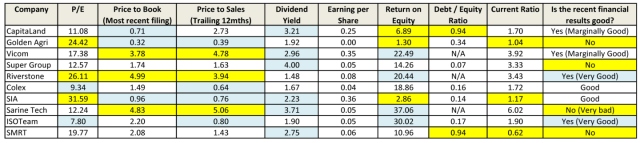

On 2 Sept 2015, I created the table below.

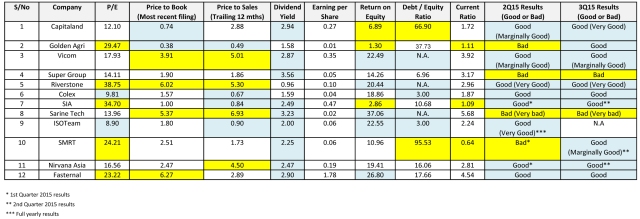

Recently, on 17 Nov 2015, I created the table below.

1) P/E ratio. I noticed that the P/E ratios of Golden Agri, Riverstone, SIA, SMRT and Fasternal are relatively high.

Riverstone as usual has a lot of good things going for it (low Malaysian currency vs USD, new factory output, etc). Moreover the recent financial results are good. It is a high growth stock, so a high P/E is not unexpected. However, its PE has increased over the period from May to Set to Nov 2015, from 16.35 to 26.11 to 38.75. I think there is now more publicity on this stock. I am not overly pleased with the high P/E actually, despite the stellar earnings and growth.

SMRT P/E ratio has risen as compared to last quarter (last quarter dropped FYI).

Capitaland, Golden Agri, SIA and Fasternal are cyclical stocks. So a better gauge would be the Price to Book ratio.

In this case, Golden Agri would appear very under-valued (dropped further from May 2015 and Sept 2015 value – from 0.47 to 0.39 to 0.38).

SIA’s high P/E warrants some concern, however its P/B acceptable at exactly 1. However, SIA’s PE has infact dropped from the high level of 66.2 in 2014. Given the good balance sheet, low fuel cost now, and active strategies by SIA, I am not too overly worried.

For Fasternal, roughly half of its business is production/construction and the other half is maintenance. The production portion of this business is very cyclical, with 75% of the customers engaged in some type of heavy manufacturing. This business is struggling right now. Fortunately for Fastenal, the sale of fasteners is a sticky business because it’s difficult for customers to change their supplier relationships. This stickiness has probably even improved as Fastenal grows its vending machine business which primarily focuses on distributing non-fastener products (instead of candy bars, Fastenal is popping out tools, equipment, and other non-fastener products through vending machines at their customers’ own facilities):

2) Price to Book: Price to book values of Vicom, Riverstone, Sarine Tech and Fasternal appear high. As compared to Sept 2015, the high P/B values of Vicom, Riverstone and Sarine Tech have risen further. For Riverstone, the high Price to Book ratios would be understandable due to its growth stock status.

Sarine Tech high P/B value seems odd because its recent results are not impressive. Nevertheless its P/E is relatively low.

Similarly for Vicom, with the recent anemic quarterly results, the high P/B value of Vicom may drop.

On the low side: Property stocks (eg. CapitaLand) are generally cheap (low Price to book), and Share price in comparison to Net Asset Value (NAV) is relatively low. Situations seems to be changing in the residential market in China. Could this be the start of the upswing in the cyclical cycle? The recent quarterly results of Capitaland (as compared to the previous quarter) is impressive.

Likewise, Golden Agri P/B value is low. The earnings of Golden Agri has improved over the last quarter. Could this be the start of a cyclical upswing? A quarter is too early to tell perhaps.

Interestingly, the current ratio of Capitaland and Golden Agri (esp. the latter) has improved over the previous quarter.

3) Price to Sales: The lower the ratio, the better since the investor is paying less for each unit of sales. Tricky ratio to evaluate, since PSRs vary greatly from sector to sector. Nevertheless, Vicom, Riverstone, Sarine Tech and Nirvana Asia have relatively high PSRs, while Golden Agri, Colex, SIA and ISOTeam have relatively low PSRs.

4) Dividend Yield: One of the favorite ratio for many investment bloggers (from what I’ve read). To begin, I did not set out to be dividend investor when I first started investing. However, over the years, as the number of stocks I invested in increased, the dividend I received has also increase. However yield is nothing spectacular.

I do not really focus on the on high dividend yield when I look at the company financials. I am more concerned about the ability of the company in increasing cash flow / earnings. It is nevertheless an important ratio (esp. for mature slow growth companies). If there is little dividend yield for mature companies, another good sign is share buybacks (provided it is not for issuance of Treasury Shares for their own management/employees later on). I do not have very high dividend yield stocks as you can see. I have no REITs or Business Trusts. On some days, I might consider myself more of a GARP investor.

Nevertheless, the better yielding stocks would be CapitaLand, Vicom, Super Group, SIA, Sarine Tech, ISOTeam, SMRT, Nirvana Asia and Fasternal.

As compared to Sept 2015, the dividend yield of CapitaLand, Vicom, Super Group and SMRT has dropped.

I have received my first dividend from ISOTeam this year. And if I am not wrong, dividend (exclude REITs) is not taxed.

“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” John D. Rockefeller

5) Return on Equity: The better performing stocks with high ROE would be Vicom, Riverstone, Sarine Tech, ISOTeam and Fasternal– still the same as in Sept 2015 (except for ISOTeam which dropped by a bit). Well, technically I consider Riverstone and ISOTeam as high growth stocks with high ROE.

The recent earnings of Vicom, Sarine Tech and Fasternal is not fantastic. Their 2015 ROE will eventually be affected.

The other figure that one might consider useful is the Compound Annual Growth rate of the EPS (CAGR) – normally can get only 5 years CAGR. A company with both high ROE and high EPS CAGR would be ideal (however not too high eg. >30%, as it would raise questions on its sustainability).

On the other end of the spectrum, the stocks with low ROE are CapitaLand, Golden Agri and SIA – still the same as in May and Sept 2015. These are big mature companies with little growth. Hope things will change for the better.

“If you can follow only one bit of data, follow the earnings — assuming the company in question has earnings. I subscribe to the crusty notion that sooner or later earnings make or break an investment in equities. What the stock price does today, tomorrow, or next week is only a distraction.” Peter Lynch

6) Debt/Equity ratio: Each industry has different debt to equity ratio benchmarks. I generally like companies with low or zero debt. As what many value investors would say, what is important is to consider the downside risk first (rather than the potential upside). In the event of any market downturn or any other catastrophic events, a company with little or no debt is very unlikely to go under. CapitaLand and SMRT have relatively high Debt/Equity ratio. However, in the case of CapitaLand, its Debt/Equity ratio has dropped considerably from Sept 2015.

CapitaLand’s high Debt/Equity ratio is understandable as it is a property developer (need to use leverage), and its debt/equity ratio in comparison to its peers in the same industry is acceptable.

SMRT is still burden by the maintenance expenditure. More recently, as I live near a MRT station, in the middle of the night (or more like early morning from 1am onwards), I would be sometime be unable to sleep well due to the noise coming from the tracks caused by the changing of the track sleepers. SMRT is replacing the timber sleepers with longer lasting concrete sleepers. I do hope the maintenance woes of this company will turn around for the better. In the meantime, it is a juggling act when it comes to the balance sheet. As a resident, I am disturbed by the noise, but as a shareholder I wish that it would lead to a better business going forward.

7) Current ratio: The current ratio is an indication of a firm’s market liquidity and ability to meet creditor’s demands. Acceptable current ratios vary from industry to industry and are generally between 1.5 and 3 for healthy businesses.

It compares a firm’s current assets to its current liabilities. (Generally the higher the no. is good). Low values for the current or quick ratios (values less than 1) indicate that a firm may have difficulty meeting current obligations.

Golden Agri, SIA and SMRT low ratios appear worrisome – same trio as in May and Sept 2015. Nevertheless SIA is a very cash rich company (though it is operating in a very competitive industry). In addition, SMRT’s current ratio has improved as compared to the ratio in Sept 2015.

8) Is the recent financial results good? I previously did a post on the quarterly financial results of the companies on 17 Nov 2015 (read here). I am glad that there are less companies in my portfolio reporting bad earnings this quarter.

In gist, as mentioned earlier, this is just a quick overview.

Sarine Tech & Golden Agri require more monitoring (they each have 3 yellow boxes – excluding the previous quarter 2Q15 results, which is more than the others).

Sarine Tech’s low performance is due to the global difficulty in the diamond trade and liquidity issues in India. There seems to be signs that market is turning better.

Hope for Golden Agri, there will be light at the end of the multi year commodity slump soon.

The other companies with 3 yellow boxes (excluding the previous quarter 2Q15 result) are Riverstone, SIA and SMRT.

- Riverstone is more due to it being overvalued (eg. high P/E, Price to Book and Price to Sales). It does have a lot of blue boxes, 3 boxes in fact (good points). And its recent earnings report is good. So am not too worried about it.

- Hope the crude oil price drop will improve SIA’s margin.

- Hope SMRT is “making progress” with the authorities regarding a new rail financing framework. Hope the maintenance (and breakdown) woes of SMRT will end soon.

So the 4 companies to worry about: Golden Agri, SIA, Sarine Tech and SMRT (same as previous quarter).

Hi T

A lot of hardwork that you have put in to study these equities. Good work here. You must have went through a pain to learn these financial skill, understanding you got no background to begin with.

LikeLike

Thanks. I think it is a mixture of responsibility and interest on why I am studying these.

If I am not wrong, Pat Dorsey once mentioned that the fastest way to make himself proficient / knowledgeable in something is for him to put money into it. Eg. Say he just arrive at India and he knows nothing about cricket. If he is made to put money on a bet on a cricket team, he would study all he can on that game and the teams until he is confident enough to bet on one.

I think there are a lot financially savvy people around us. But if they have no ‘skin’ in the company… it is unlikely they care as much.

LikeLike